Advertisement|Remove ads.

Spirit Airlines Rallies Pre-Market As Jet Sales, Layoffs Signal Survival Strategy: Retail Sentiment Bullish

Spirit Airlines Inc. ($SAVE) stock surged as much as 12% in pre-market trading on Friday after announcing new cost-cutting measures to tackle its financial challenges, including staff layoffs and aircraft sales.

In an 8-K filing, Spirit Airlines disclosed plans to cut about $80 million in costs early next year, focusing on slashing flight coverage and laying off employees.

“These cost reductions are driven primarily by a reduction in workforce commensurate with the company’s expected flight volume,” the company said.

The company will also sell off 23 of its jets for an expected purchase price of $519 million to the aircraft maintenance company GA Telesis.

Shares of Spirit Airlines have been all over the charts this week. The stock tumbled over 21% on Thursday, closing at $2.42. This is the third time the airline’s shares have bounced back this week alone.

The stock rallied on Monday after Spirit Airlines struck an 11th-hour deal to extend a debt-refinancing deadline to December, then climbed again on Wednesday on reports of a merger with rival Frontier Airlines ($ULCC).

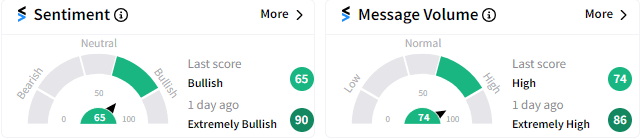

Retail sentiment on Stocktwits has dipped into the ‘bullish’ (65/100) zone from ‘extremely bullish’ a day ago.

Spirit Airlines anticipates that proceeds from its asset sale, along with the discharge of aircraft-related debt, will boost its liquidity by roughly $225 million through the end of next year.

The company also expects to close the year with over $1 billion in liquidity, “assuming that the company is able to consummate those initiatives that are currently in process.”

Shares of Spirit Airlines have fallen 84% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/rich-money-2025-04-f0b4073db42c6bc97979f963f46d5013.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/03/filter-coffee.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/metal-and-mining-2025-10-7f1cf8d6ed7a5d31e2971be9b93f8539.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2025-10-24t181332z-2012779548-rc2hihawafmm-rtrmadp-3-grindr-m-a-2025-10-eb89b2d5d1b2c7ee27da768ccd3a2e66.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/jane-2-2025-10-0cb531b3a4a4595817838ded781057b1.jpg)