Advertisement|Remove ads.

Jindal Stainless Could See Strong Upside If It Breaks Above ₹695: SEBI RA Vijay Gupta

Jindal Stainless is showing signs of short-term accumulation, with the price consolidating just below a key breakout level near ₹695.

On the daily chart, the stock is trading close to both the Tenkan Sen conversion line at ₹692.43 and the Kijun Sen baseline at ₹693.46, according to SEBI-registered analyst Vijay Kumar Gupta.

At the time of writing, Jindal Stainless stock edged 0.5% higher to ₹684.55, having fallen 2.07% year-to-date.

The price is currently testing the top of the Ichimoku Cloud, and the flat cloud ahead suggests a potential sideways-to-bullish trend, the analyst noted. The Lagging Span (Chikou) is near current price candles, indicating a neutral setup with no clear divergence or strong momentum shift yet.

Momentum indicators are also showing recovery. The Commodity Channel Index (CCI) is rebounding from the oversold zone with a potential bullish crossover ahead, adding further weight to a possible upward move.

Volumes have hit 827K, the highest in five sessions, while On-Balance Volume (OBV) remains steady, reflecting no signs of distribution, Gupta said.

A breakout above ₹695 - ₹700 could trigger bullish momentum, if supported by a strong close above ₹700. Key support can be seen at the ₹665 - ₹670 range, he added.

Analysts remain optimistic, with Motilal Oswal assigning a target price of ₹770. If the stock holds above ₹695 and closes above ₹700, it could set up a quick move toward ₹ 730 or higher in the short term.

On the fundamental front, Jindal Stainless delivered a strong Q4 FY25 performance, with PAT surging 94% to ₹590 crore and annual revenue growing 13% to ₹40,182 crore.

A robust balance sheet with a low net debt-to-equity ratio of 0.2, along with capacity expansion through Chromeni and investments in renewable energy, enhances the long-term growth story.

Sectoral tailwinds from rising stainless steel demand in infrastructure, railways, and defense further support sentiment, the analyst said.

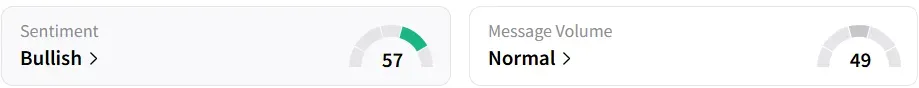

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day ago.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)