Advertisement|Remove ads.

Jio Financial Breaks Out After Fundraising Nod: SEBI RA Mayank Singh Chandel Sees Over 15% Upside Ahead

Reliance Industries’ financial services arm Jio Financial traded 3% higher in a weak market on Thursday after its board approved fundraising up to ₹15,825 crore.

At the time of writing, Jio Financial Services’ shares were trading at ₹329.90.

Post-market on Wednesday, Jio Financial informed the exchanges that its board has approved raising funds via a preferential issue of 50 crore warrants at ₹316.50 each. These warrants, convertible into one fully paid-up equity share each, will be allotted to members of the promoter group.

Technical Outlook

On the technical charts, Jio Financial is showing signs of a clear trend reversal, noted SEBI-registered analyst Mayank Singh Chandel.

After a prolonged downtrend from April 2024 to March 2025, the stock has broken out above its falling trendline and is now trading above both the 50-day and 200-day moving averages, typically a strong bullish signal, Chandel said.

Recently, the price retested the key support around ₹305 and bounced back with strong volume. The relative strength index (RSI) is currently at 56, suggesting bullish momentum with further buying headroom.

Chandel flagged a swing trade opportunity in the ₹322.6 - ₹326.6 range, with a stoploss at ₹293.9. He expects the stock to climb to ₹355 and then to ₹380, offering a favorable risk-reward setup in short to medium term.

What’s Working For Jio Financial?

While operating cash flow has turned negative and margins have dipped slightly, overall revenue and profit continue to grow steadily, the analyst said. A key highlight is the sharp growth in Jio Credit’s AUM, along with the solid performance of the newly launched fund in collaboration with BlackRock.

Additionally, the company is looking to raise more capital, and market chatter around a possible promoter stake increase further reinforces long-term confidence, Chandel said.

What’s The Retail Mood?

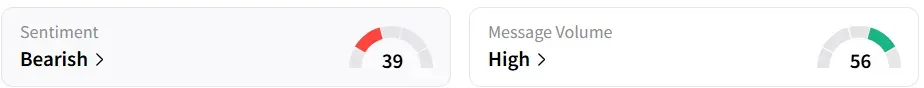

However, retail sentiment on Stocktwits remained ‘bearish’ amid ‘high’ message volumes. It was ‘bullish’ a month ago. It is also among the top 10 most trending stocks on the platform.

Year-to-date, the shares have climbed 10.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)