Advertisement|Remove ads.

Joby Aviation Stock Takes Off As Toyota Pledges $500M More To Fuel Electric Air Taxi Ambitions: Retail’s Charged Up

Shares of Joby Aviation Inc. surged 24% Wednesday after Toyota Motor pledged an additional $500 million to support the certification and commercial production of Joby’s electric air taxis.

The investment, split into two tranches, brings Toyota’s total commitment to Joby to $894 million as the automaker doubles down on its air mobility ambitions.

Toyota’s North America CEO, Tetsuo “Ted” Ogawa, emphasized that the company shares Joby’s vision of sustainable flight as a solution to modern transportation challenges.

Cantor Fitzgerald maintained its ‘Overweight’ rating and $10 price target, and said the deal would extend Joby’s financial runway by three quarters.

H.C. Wainwright reiterated its ‘Buy’ rating on JOBY, noting that Toyota’s investment underscores strong backing from strategic partners.

Joby has made significant strides in the electric vertical take-off and landing (eVTOL) sector.

In addition to this fresh capital injection, the company plans to build a manufacturing facility in Dayton, Ohio, capable of producing 500 eVTOL aircraft annually.

Recent milestones include delivering its first aircraft to Edwards Air Force Base and securing partnerships in the UAE to help develop an air-taxi ecosystem, with service in Dubai expected to launch as early as next year.

Retail investors are increasingly taking note.

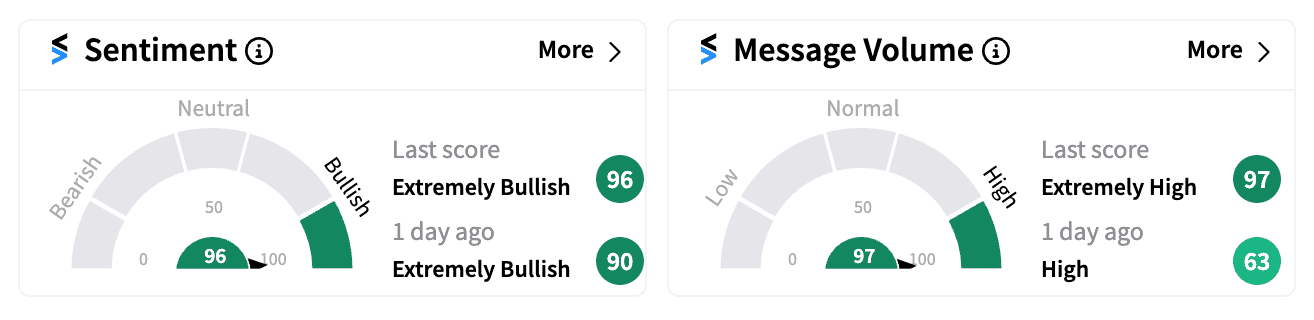

On Stocktwits, message volumes about JOBY jumped 175% in the past week, and sentiment on Wednesday reached an ‘extremely bullish’ (96/100) — the highest level this year.

The stock, which has lost roughly 50% from its SPAC merger in August 2021, now has a market cap of just $3.4 billion.

But Joby’s ambitious plans are gaining momentum, and the additional support from Toyota signals a powerful vote of confidence in the company’s future as a leader in the eVTOL space.

Read next: Tesla Stock Slips Back Into The Red For 2024 After Q3 Delivery Miss: Retail Turns More Jittery

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AT_and_T_store_resized_542005da9b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_barr_OG_jpg_6005cfe225.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667440_jpg_c3b8e52a81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1207431426_jpg_b8d7c6d852.webp)