Advertisement|Remove ads.

Tesla Stock Slips Back Into The Red For 2024 After Q3 Delivery Miss: Retail Turns More Jittery

Tesla Inc. (TSLA) shares fell more than 5% Wednesday after the company missed analysts’ delivery expectations for the third quarter, raising investor concerns.

The electric-vehicle giant reported deliveries of 462,890 vehicles, a 6.4% year-over-year increase but just shy of the 463,900 units analysts had anticipated.

Production totaled 469,796 vehicles, slightly above the consensus of 466,000, leading to an inventory build-up of around 120,000 units.

While Tesla’s delivery numbers marked the first quarterly increase in 2024, analysts had expected stronger results, particularly with the boost from China’s expanded EV incentives.

Barclays highlighted the underperformance of Tesla’s higher-end models like the Model S, X, and the Cybertruck as contributing factors. The brokerage maintained an ‘Equal Weight’ rating on the stock with a $220 price target.

Evercore ISI called the numbers a “slight expectational disappointment,” given the heightened analyst forecasts.

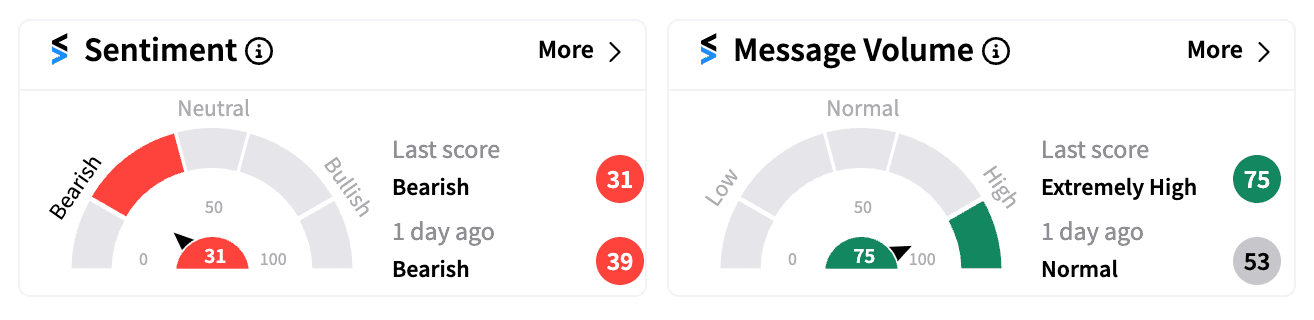

Retail sentiment on Stocktwits turned increasingly ‘bearish’ (31/100), with message volume spiking to extremely high levels.

Tesla’s stock, already the worst performer in the ‘Magnificent Seven’ group, was dragged back into the red for the year. The stock had reportedly soared over 30% in the eight weeks leading up to Wednesday’s report.

Investors now look ahead to the company’s Q3 financial results, scheduled for Oct. 23, and the highly anticipated “robotaxi” event on Oct. 10, where CEO Elon Musk is set to showcase new self-driving vehicle prototypes.

Read next: Humana Stock Crashes, Drags Retail Sentiment To 1-Year Low On Medicare Star Rating Troubles

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)