Advertisement|Remove ads.

Johnson & Johnson Reportedly Halves Its Forecast Of US Tariff Impact To $200M, Sparks Retail Chatter

Johnson & Johnson (JNJ) has reportedly revised its forecast of the impact of U.S. President Donald Trump’s tariffs to $200 million, down from the firm’s estimate of $400 million made in April, following a pause on the trade levies on China, as well as other retaliatory tariffs.

J&J shares were up 2.3% in premarket trading on Wednesday after the company raised its 2025 adjusted profit per share forecast for the year to between $10.80 and $10.90, compared with a prior expectation of $10.50 to $10.70.

The company faces tariff pressures primarily in its medical device and pharmaceutical supply chains, notably on imported components, such as steel and aluminum, as well as on raw materials used in drug manufacturing.

To offset the impact, the firm announced a $55 billion investment in March to ramp up production in the United States for advanced medicines over the next four years, aiming to reduce its exposure to future tariff-related disruptions.

According to a Reuters report that cited Chief Financial Officer Joseph Wolk, J&J was able to absorb the tariffs and still raise its annual profit forecast. He added that the company was not ready to forecast the impact of tariffs for 2026.

Medical-device sales climbed 7.3% in the second quarter, driven by Abiomed, the company’s cardiovascular-focused medical technology unit, and higher demand for electrophysiology and wound-closure products in General Surgery.

J&J’s pharmaceutical segment posted a 4.9% increase, fueled by strong growth of oncology therapies such as Darzalex, Carvykti, and Erleada.

“Our portfolio and pipeline position us for elevated growth in the second half of the year, with game-changing approvals and submissions anticipated in areas like lung and bladder cancer, major depressive disorder, psoriasis, surgery, and cardiovascular,” CEO Joaquin Duato said in a statement on Wednesday.

The company raised its annual sales forecast to between $93.2 billion and $93.6 billion, up from the previous expectation of $91 billion to $91.8 billion.

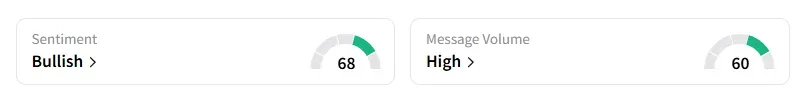

Retail sentiment on the stock improved to ‘bullish’ from ‘neutral’ a day ago, with chatter at ‘high’ levels, according to Stocktwits data.

J&J’s shares have risen over 7% year-to-date but have lost nearly 1% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)