Advertisement|Remove ads.

Johnson & Johnson’s Q1 Earnings Beat Estimates, 2025 Guidance Revised To Account For Intra-Cellular Therapies Acquisition: Retail’s Positive

Johnson & Johnson (JNJ) shares were in the spotlight on Tuesday morning after the company reported first quarter earnings above Wall Street estimates.

The company reported quarterly sales of $21.89 billion, marking a growth of 2.4% from the corresponding period of last year and above an analyst estimate of $21.57 billion, as per FinChat data.

Sales in the U.S. accounted for $12.31 billion of the company’s overall sales, marking a growth of 5.9% from last year. Outside the U.S., the company’s sales fell by 1.8% to $9.59 billion.

Earnings per share on an adjusted basis for the quarter was $2.77, up from $2.71 in the first quarter of 2024 and above an expected $2.64.

The company reported a 2.3% jump in sales from its innovative medicine segment to $13.87 billion while medtech segment sales rose 2.5% to $8.02 billion.

The company said the rise in sales in the innovative medicine segment was driven primarily by its oncology drugs, including Darzalex, Carvykti, and Erleada.

Sales growth of these drugs, together with others such as Tremfya and Xarelto, helped the company offset the drop in sales of its immunology drug Stelara.

While Darzalex sales jumped 20.3% to $3.24 billion, Erleada sales rose 11.9% to $771 million. Stelara sales, however, dropped a steep 33.7% to $1.63 billion.

The company said the growth in MedTech sales was primarily driven by Abiomed, a cardiovascular and wound closure product.

Abiomed sales jumped 13.3% to $420 million in the three months through the end of March.

The company raised its operational sales forecast for full-year 2025 to $91.6 billion—$92.4 billion from its previous guidance of $90.9 billion—$91.7 billion to reflect the addition of the schizophrenia drug Caplyta to its portfolio following the completion of the acquisition of Intra-Cellular Therapies.

However, it lowered its full-year adjusted operational earnings per share forecast to $10.50 – $10.70 from $10.75 – $10.95, after accounting for dilution from the Intra-Cellular Therapies acquisition announced in January.

The updated guidance, the company said, includes costs estimated to be incurred as part of Trump’s tariffs on certain imports into the U.S.

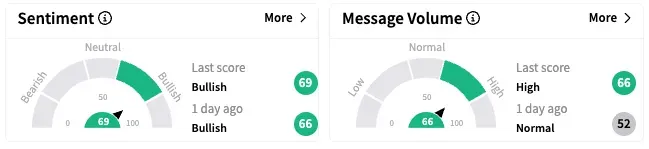

On Stocktwits, retail sentiment around Johnson & Johnson rose in the ‘bullish territory’ over the past 24 hours while message volume rose from ‘normal’ to ‘high’ levels.

JNJ stock rose by over 7% year-to-date and nearly 5% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)