Advertisement|Remove ads.

Johnson Controls Stock Jumps As New CEO’s Appointment Sparks UBS Upgrade, Price Target Hike: Retail’s Still Bearish

Shares of Johnson Controls International (JCI) rose over 2% on Monday after UBS upgraded the stock to ‘Buy’ from ‘Neutral’ while raising the price target to $103 from $90, implying nearly 15% upside from current levels.

The analyst upgrade follows last week’s appointment of Joakim Weidemanis as the new chief executive.

Weidemanis held several executive leadership roles over his 13-year career at Danaher Corporation and most recently served as Executive Vice President of Diagnostics and China at Danaher. He was responsible for operational leadership of an approximately $15 billion group across eight global technology businesses.

According to a CNBC report, the UBS analyst cited Weidemanis’ success in increasing operating margins at Danaher’s diagnostics business and the potential to replicate the performance for Johnson Controls.

“The bottom line is we see meaningful incremental margin potential, and we view the company’s ability to execute as better following strategic actions and new management appointments,” the analyst said, according to the report.

The UBS analyst also stated that Weidemanis’s appointment provides “greater confidence” in the potential for profit improvement but noted the challenge in this work, given that it will require a “structural change” within the firm.

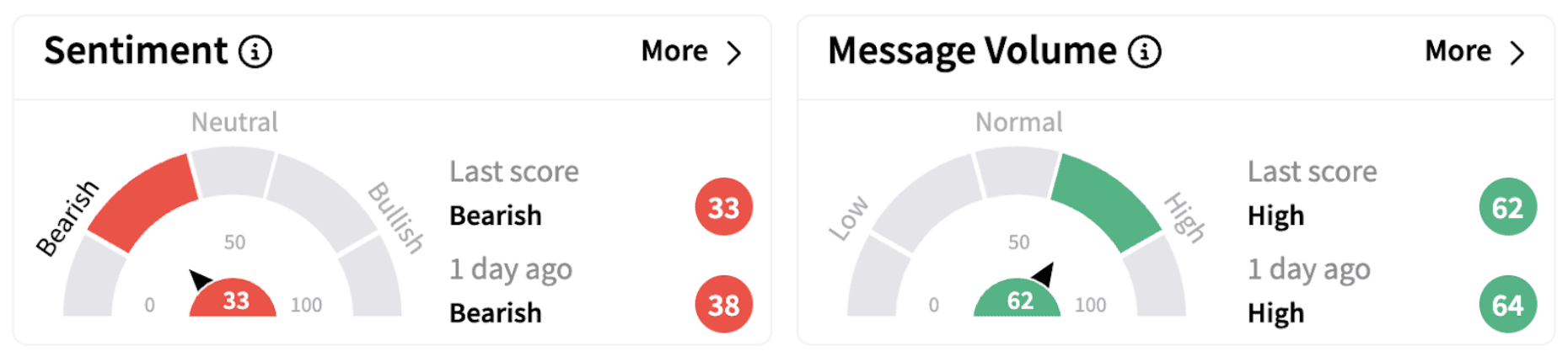

Despite the positive news, retail sentiment on Stocktwits continued to trend in the ‘bearish’ territory (33/100) accompanied by ‘high’ message volume.

According to TheFly, Barclays recently raised its price target on JCI to $88 from $83 while keeping an ‘Equal Weight’ rating on the stock. JPMorgan raised its price target on Johnson Controls to $100 from $87 while keeping an ‘Overweight’ rating.

JCI stock has gained over 13% in 2025 and has risen over 61% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)