Advertisement|Remove ads.

AmEx Stock Falls After CFO Reportedly Says Wall Street’s Q1 Expectations Are Too High: Retail Stays Bullish

Shares of American Express Co (AXP) fell over 2% on Monday after CFO Christophe Le Caillec reportedly said that the first-quarter expectations from analysts and investors are too high.

“You know, when we analyze their — either the sequential here — sequentials between Q4 and Q1, the expectation from investors and analysts is that, you know, this would be pretty flat, and it cannot be flat,” he said at a UBS conference, according to TheFly.

“…we have one less day, right? Last year was a leap year. So, for us, that translates into about 1 percentage point of growth,” Le Caillec said.

According to a Barron’s report, the CFO also said that the strength of the U.S. dollar is a headwind to the firm’s growth, noting that the dollar is a bit stronger now than it was in late December.

Meanwhile, Keefe Bruyette noted that American Express provided incremental guidance around Q1 while maintaining continued confidence in achieving its 2025 guidance of 8%-10% revenue growth and earnings per share of $15.00 to $15.50.

Keefe Bruyette highlighted that it was pleased with the firm’s Q4 performance and noted that while it is still too early for what it means for the balance of 2025, there is a bit more optimism.

The brokerage said that while American Express's full-year guidance is intact, Q1 will be "more lumpy" due to leap year and currency. The firm has an ‘Outperform’ rating on the shares with a $360 price target.

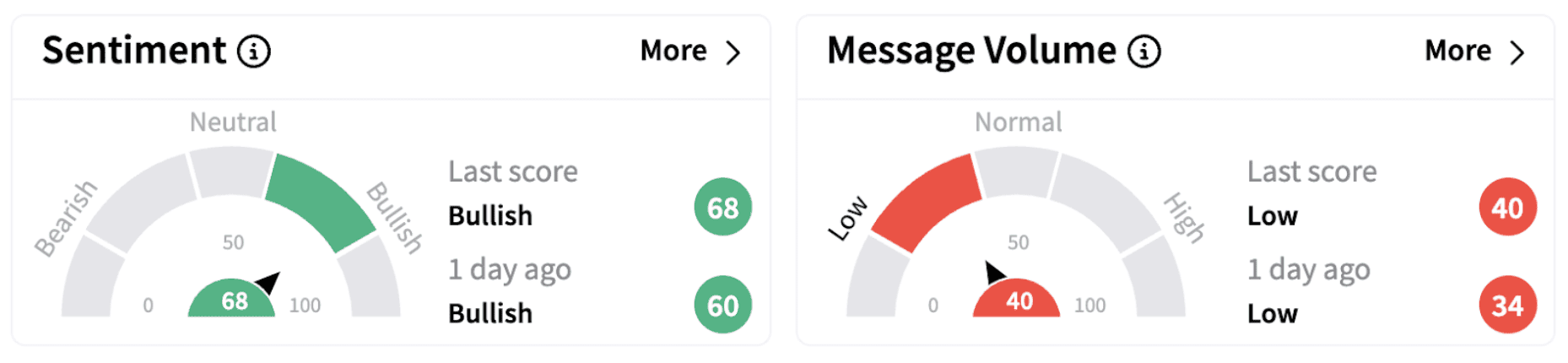

On Stocktwits, retail sentiment continued to trend in the ‘bullish’ territory (68/100).

For the first quarter, American Express is expected to report earnings per share (EPS) of $3.54 on revenue of $17.1 billion, according to FinChat.

American Express shares have risen over 3.5% in 2025 and have gained over 45% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)