Advertisement|Remove ads.

JPMorgan Stock Slides As Bank Warns Of $105B Expenses In 2026 And Low-Teens Markets Growth For Q4

- Credit trends are stabilizing, with 2025 card charge-offs now expected at about 3.3%.

- Consumers remain resilient but are becoming more selective as cash buffers normalize.

- Card growth remains strong, with JPMorgan still on track for roughly 10.5 million new accounts this year.

JPMorgan Chase & Co. (JPM) shares fell nearly 5% on Tuesday after Consumer and Community Banking CEO Marianne Lake said the bank expects 2026 expenses to reach about $105 billion and forecast fourth-quarter (Q4) markets revenue will rise in the low-teens percentage range year over year. Lake delivered the comments at the Goldman Sachs U.S. Financial Services Conference.

Lake added that investment banking fees should rise in the low single digits in Q4.

Drivers Behind JPMorgan’s Higher 2026 Cost Outlook

Lake said the firm now expects $105 billion in total expenses next year, driven by volume- and growth-related costs in areas such as cards, branches and auto leasing, along with strategic investments in AI, technology, branch expansion, advisor hiring and marketing, and by structural pressures from inflation and real estate costs.

She said consumers and small businesses remain resilient, although she noted they have less capacity to handle additional stress because cash buffers have returned to more normal levels and prices remain elevated. She said households are becoming more discerning, including trading down and paying closer attention to promotions, even as spending stays solid across income groups.

Lake described the overall environment as more fragile given softer labor demand, low sentiment and high price levels, and she said the bank expects unemployment to edge higher next year, which would show up in consumption.

Early Credit Trends Improve

Early delinquencies in cards remain stable or improving, and Lake said JPMorgan now expects 2025 credit card charge-offs of around 3.3%, below its prior estimate of 3.6%. Subprime auto delinquencies tied to negatively selected 2022 and 2023 vintages are normalizing, while 2024 and 2025 vintages look more typical.

JPMorgan remains on track for about 10.5 million new card accounts this year, a level that already incorporated the Chase Sapphire refresh. Lake said the refresh has generated strong engagement, alongside updates to United Quest and Southwest cards. Annual fee revenue continues to grow at double-digit rates, supported by higher benefits and stronger merchant partnerships.

AI Drives Productivity

Lake highlighted AI as a major driver of long-term efficiency, noting the bank expects 40% to 50% productivity gains per operations specialist over five years.

Productivity improvements have already doubled from about 3% annually to roughly 6%, driven by automation, AI-assisted tools for employees, and improved document and voice processing. She said more advanced agent-based AI systems will follow, helping with complex tasks such as fraud investigations and complex account openings.

How Did Stocktwits Users React?

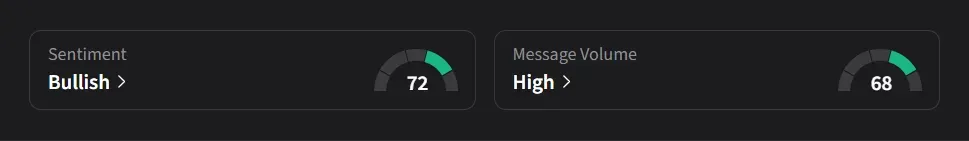

On Stocktwits, retail sentiment for JPMorgan was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user quipped that the stock was being beaten up for speaking too honestly about the economy.

Another user said, “thanks for the discount, picked up a few on 5% discount, solid business, killer growth, lets go!!”

JPMorgan’s stock has risen 28% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)