Advertisement|Remove ads.

JPMorgan Rolls Out Stablecoin JPMD On Coinbase – ‘On-Chain Payments Are The Future’ Says Brian Armstrong

- JPMorgan’s stablecoin enables instant, 24/7 payments for institutional transfers, bypassing traditional banking delays.

- The pilot period involved firms including Mastercard, Coinbase, and B2C2.

- JPMorgan has plans to expand its usage to clients’ customers, other currencies, and additional blockchains in the future.

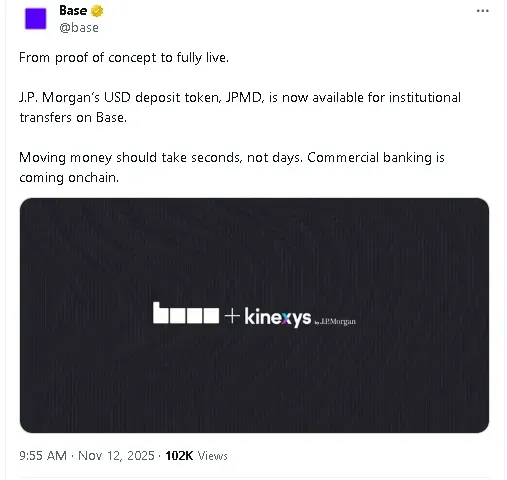

Coinbase (COIN) announced Wednesday that JPMorgan Chase (JPM) has begun distributing its dollar-backed stablecoin, JPM Coin (JPMD), on Base, Coinbase’s Ethereum layer-2 network.

“From proof of concept to fully live. J.P. Morgan’s USD deposit token, JPMD, is now available for institutional transfers on Base,” Base said in a post on X announcing the launch. “Moving money should take seconds, not days. Commercial banking is coming on-chain.”

Coinbase CEO Brian Armstrong also chimed in on a post on X, stating, “On-chain payments are the future.”

JPM’s stock gained 1.4% in afternoon trade on Wednesday. However, on Stockwits, retail sentiment around the bank continued to trend in ‘bearish’ territory over the past day. Meanwhile, COIN’s stock edged 0.3% lower, with retail sentiment dropping to ‘neutral’ from ‘bullish’ territory. Coinbase also announced that its reincorporating to Texas from Delaware on Wednesday.

Giving Clients Around-The-Clock Payments

The token, which represents dollar deposits held at JPMorgan, allows users to send and receive funds via Coinbase’s public blockchain Base. Unlike traditional banking, which can take days to process payments, JPMD enables transactions to settle in seconds and operate 24/7.

The rollout follows a pilot period involving firms such as Mastercard, Coinbase, and B2C2. JPMorgan plans to extend access to its clients’ customers and expand JPMD to other currency denominations, pending regulatory approval, the global co-head of Coinbase’s Kinexys blockchain division, Naveen Mallela, told Bloomberg. The bank also intends to deploy the token on other blockchains in the future.

JPMorgan Expands Blockchain Footprint

The pilot for JPMD was first announced in June. JPMorgan has also trademarked the ticker JPME for a potential euro-denominated stablecoin, Mallela added.

The launch represents a significant milestone in JPMorgan’s blockchain initiatives, joining a growing number of global banks and companies, including Citigroup and PayPal. There has been a surge in financial institutions experimenting with digital assets to make payments faster and reduce costs after the GENIUS Act passed earlier this year.

Read also: OpenAI Accuses Times Of Overreach In Demand For 20 Million Private ChatGPT Conversations

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)