Advertisement|Remove ads.

JPMorgan Stock Slides After COO Warns NII Expectations Are ‘Bit Too High:’ Retail Ignores Warning

JPMorgan Chase & Co (JPM) shares fell nearly 7% on Tuesday after the bank’s President and Chief Operating Officer Daniel Pinto reportedly said that forecasts for its net interest income were very optimistic.

Net interest income (NII) is the difference between interest earned and interest expended. "NII expectations are a bit too high," Pinto stated. "Next year is going to be a bit more challenging,” he said, according to a Reuters report.

Pinto also reportedly stated that Q3 markets revenue is expected to be flat to up about 2% year-over-year and cautioned that expenses "could inch up higher.” At the same time, the executive stated that wealth management is a key focus area for the firm’s overall consumer business strategy.

Pinto also described Q3 performance in capital markets as very solid, but projected that M&A volume would be flat in volume.

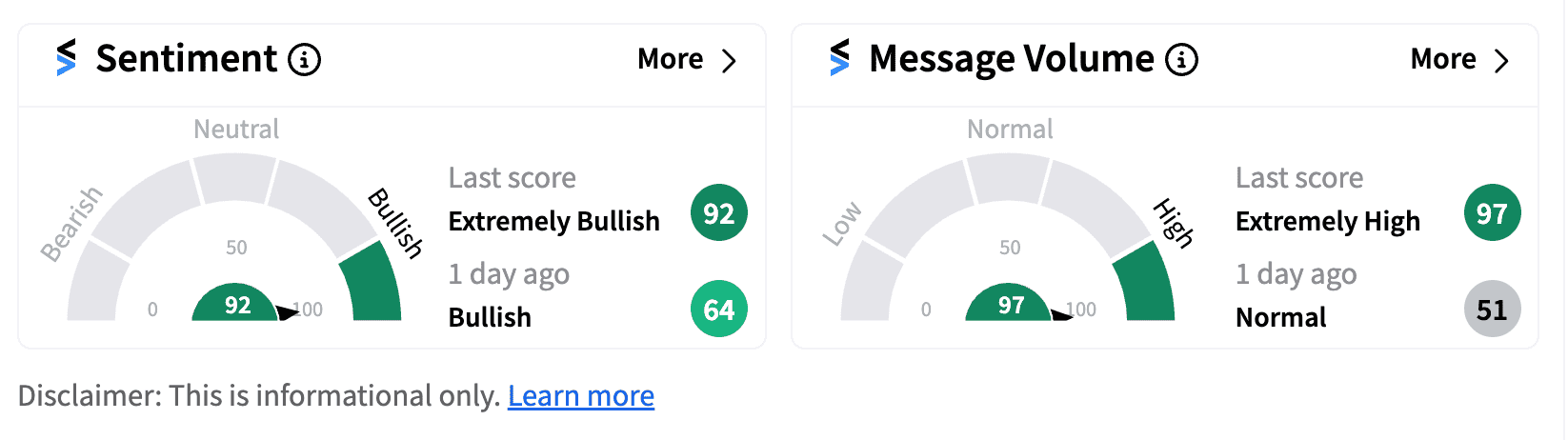

Although the comments appeared to have taken Wall Street by surprise, as is reflected in the stock price, retail followers of the ticker on Stocktwits were ‘extremely bullish’ (92/100) on the stock compared to 'bullish' a day ago.

Bullish followers of JPMorgan believe Tuesday’s sell-off in the stock could have been overdone and that it may be time to buy the dip.

Others believe the stock will bounce back to $205-$208 levels pretty soon.

Notably, JPMorgan shares have gained over 17% since the beginning of the year.

Meanwhile, U.S. regulators will make a proposed revision to bank-capital rules that would reduce the expected impact to the largest banks by half. The proposed revisions would reportedly trim in half the 19% capital hike that regulators had proposed for the eight biggest US banks, including Citigroup Inc. (CITI), Bank of America Corp. (BAC) and JPMorgan.

Shares of Citi were trading over 4% lower while Bank of America shares were down nearly 3% on Tuesday.

Also See: Rocket Lab USA Hires Former Rivian Executive Frank Klein As COO: Retail’s Not Happy Yet

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1836899973_jpg_3131fc01af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243898515_jpg_248ded048d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2223999324_jpg_f7b09c5fc1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/ibla-jury-panel-31oct-2025-10-9b6a410a2c6a926427d5bef75c5db47d.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/12/startup-funding.jpg)