Advertisement|Remove ads.

‘Apple Is Like Tesla’ – Dan Ives Sees AI Driving Next Growth Phase

- Ives said Apple’s iPhone 17 could see sales of up to 250 million units, surprising analysts with pent-up demand.

- He also highlighted Apple’s Google AI partnership as key for stock growth.

- Ives added that Apple may need to expand its M&A strategy to acquire AI startups, citing missed opportunities.

Apple Inc. (AAPL) could see its next major growth cycle driven by artificial intelligence, according to Wedbush analyst and Eightco Holdings Chairman Dan Ives, who defended his bullish stance on the stock in a Friday interview.

“Apple is like Tesla – what’s going to drive it is AI.”

– Dan Ives, Managing Director and Senior Equity Research Analyst, Wedbush

In a live stream on X, Ives said that the iPhone maker’s next upgrade cycle and partnership with Google will be key catalysts for future gains. Apple’s stock edged 0.15% higher in afternoon trade with retail sentiment on Stocktwits trending in ‘extremely bullish’ territory as chatter surged to ‘extremely high’ from ‘high’ levels over the past day.

Ives' comments follow the company's earnings report of $1.85 per share, which topped analysts’ estimate of $1.78, according to Koyfin data. Its revenue came in at $102.47 billion, surpassing forecasts of $102.23 billion.

Betting On iPhone 17 Demand

Ives, who has long been one of Wall Street’s most optimistic Apple watchers, said pent-up demand for the upcoming iPhone 17 could result in sales of up to 250 million units — a figure that he said was “never in the cards” for Apple just a few months ago. “It’s almost like a surprise upgrade cycle,” he said.

Ives compared Apple’s position to that of Tesla (TSLA), saying both companies are seen as lagging in AI but are poised to benefit from the technology’s next wave of consumer applications. “They’ve been on the outside looking in, but with that install base and consumer AI, that’s what you’re playing for now,” he said.

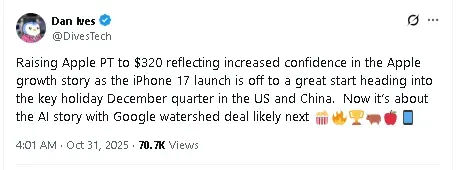

Beyond hardware, Ives pointed to Apple’s services segment — which continues to grow at a mid-teens rate — and an expected AI partnership with Google as the drivers that could lift Apple’s stock toward the $400 mark. “That’s how you get a $400 stock,” he said. In a post on X, earlier in the day, Ives raised his price target on Apple from $310 to $320.

M&A Strategy May Shift Amid AI Push

The analyst also suggested that Apple may need to reconsider its traditionally conservative M&A strategy. “They could have bought Perplexity or other AI startups, but now they have no choice — Google has to be the all-in partner,” Ives said.

Speaking after returning from Asia, Ives said his conversations with Apple’s suppliers suggested demand has significantly improved. “There’s been a significant uptick in Apple’s supply chain,” he said, calling recent weakness in the shares a “knee-jerk reaction.”

AI Capex Boom Fuels Tech Stocks

Ives also noted a surge in AI-related capital spending by tech giants such as Nvidia (NVDA), Amazon (AMZN), and Microsoft (MSFT). “Demand is off the charts,” he said. “It’s validation for the hype — the numbers actually exceed the hype.”

“Tesla and Amazon are the two biggest AI plays in the market,” Ives said, adding that Apple is now positioning itself to join that group as the technology becomes central to its next phase of growth.

Read also: Bitcoin’s ‘Uptober’ Turns Into ‘Downtober’ – Analyst Warns Of Potential Pullback To $80K

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)