Advertisement|Remove ads.

Jumia Technologies Falls 48% After Fundraise Disclosure But Retail Focuses On Improving Operating Metrics

Africa-based e-commerce platform Jumia Technologies’ shares dove nearly 48% on Tuesday after the firm announced its intention to raise funds by issuing over 20.22 million American Depositary Shares (ADS).

The firm intends to use the proceeds to help support customer acquisition, expansion of supplier base, scaling its logistics network and improving marketing and vendor technology. It also cited general corporate purposes.

However, retail investors are shrugging-off the fundraise news while concentrating on its improving operating metrics.

Jumia Technologies’ Q2 revenue declined 17% year-over-year (YoY) to $36.50 million but operating loss narrowed to $20.20 million compared to $22.10 million in the same period a year ago.

The firm said its quarterly cash burn declined 55% driven by effective cost management and reduction in finance costs. Its finance costs for the second quarter were mainly influenced by losses recognized on the sale of financial assets. Jumia also reported a 35% jump in its gross merchandise value (GMV) at $170.10 million (constant currency basis).

Notably, 67% of the company’s liquidity position was held in U.S. dollars as of the second quarter of 2024. Jumia said it continues to refine its cash repatriation strategy.

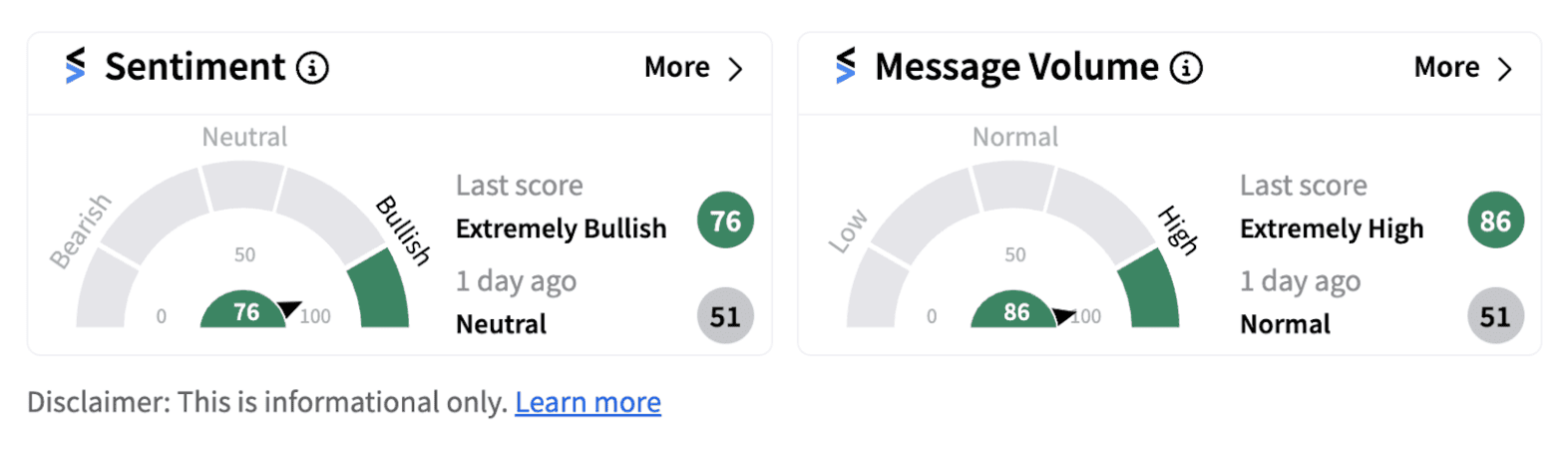

Following the announcement, retail sentiment shifted into the ‘bullish’ territory (76/100) from the bearish zone, while message volumes hit a one-year high.

The firm is also attracting more quality customers, showing a 262 basis points YoY improvement in repurchase rates during the first quarter of 2024.

According to the company’s analysis, 36% of new customers who placed an order for a product or a service on its platform in Q1 completed a second purchase within 90 days. “This represents an improvement compared to 33% of new customers from the first quarter of 2023, who reordered within 90 days,” it said.

Jumia now projects an increase in both orders and GMV in 2024, excluding the potential impact of foreign exchange. Stocktwits bulls are betting on the long-term prospects of the firm while expecting continued improvements in its underlying business trends.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)