Advertisement|Remove ads.

Kaival, Capri, And DoorDash Dominate Stocktwits Chatter Among Consumer Stocks: Find Out Why

Retail chatter surrounding Kaival Brands, Capri Holdings, and DoorDash saw a whopping jump on Stocktwits, with chatter ranging between ‘bullish’ and ‘extremely bullish’ territory, making these three the top-discussed consumer and retail companies over the last 24 hours.

Here’s a detailed look at these companies:

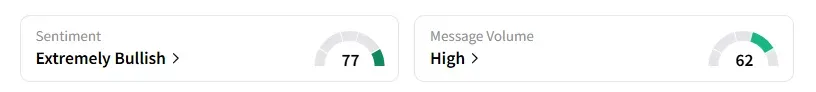

1. Kaival Brands Innovations Group (KAVL): The retail user message count for the stock jumped 2,233% on Stocktwits in the last 24 hours, with no particular news from the company. Retail sentiment on Kaival Brands improved to ‘extremely bullish’ from the ‘bearish’ territory a day ago, with chatter at ‘high’ levels, according to data from Stocktwits.

Shares of Kaival Brands were up 7% at $0.51 in premarket trading on Thursday, but have lost nearly 50% of their value so far this year. A bullish user on Stocktwits noted that once the stock hits $0.55, it will further shoot up.

https://stocktwits.com/SpartanVI/message/624077994

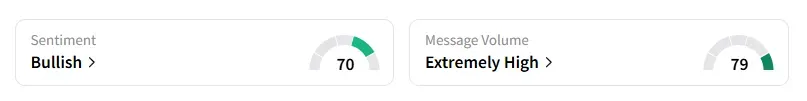

2. Capri Holdings (CPRI): The message count on Stocktwits for Capri increased 2,000% over the last 24 hours following its first-quarter results announcement on Wednesday. Retail sentiment on Capri improved to ‘bullish’ from ‘neutral’ territory, with chatter at ‘extremely high’ levels, according to Stocktwits data.

Capri’s interim CFO, Rajal Mehta, said on Wednesday that the company will implement targeted price increases in fiscal 2027 to offset the impact from higher costs tied to U.S. President Donald Trump’s tariff policies on global trading partners.

The company, after the merger fallout with Tapestry (TPR), has been undergoing a turnaround to improve sales of Michael Kors through e-commerce growth. Telsey Advisory Brokerage raised its price target to $22 from $20 and maintained a ‘Market Perform’ rating on Thursday.

“We continue to see meaningful work that needs to be done, particularly at its largest brand, Michael Kors,” Dana Telsey of Telsey Advisory Group said. Capri stock has declined 1% year-to-date and has lost over 35% in the last 12 months.

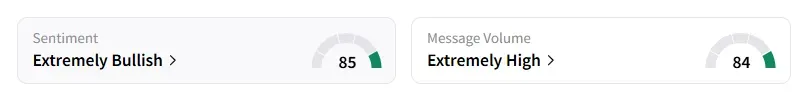

3. DoorDash (DASH): The retail user message count on the stock rose 1,650% in the last 24 hours following its better-than-expected second-quarter results on Wednesday, announced after the closing bell. Retail sentiment on DoorDash improved to ‘extremely bullish’ from ‘bullish’ a day ago, with chatter levels ‘extremely high,’ according to data from Stocktwits.

DoorDash continues to benefit from strong demand for delivery services, especially across key markets like the U.S. and Canada, and also from foraying into categories such as groceries, alcohol, electronics, and beauty products, which has further fueled order growth.

DoorDash stock has gained 8% in premarket trading and has jumped over 53% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Peloton Reportedly Laying Off 6% Of Its Staff In Another Round Of Job Cuts To Trim Expenses

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)