Advertisement|Remove ads.

Dycom Bets Big On Data Centres With $1.95 Billion Power Solutions Acquisition

- Power Solutions will continue to operate under its existing brand, with no changes to the management team.

- The company's GAAP earnings per share rose 35.4% to $3.63.

- Retail sentiment on Stocktwits flipped to ‘bullish’ from ‘bearish’ a day earlier.

Dycom Industries, Inc. (DY), on Wednesday, signed an agreement to acquire Power Solutions for $1.95 billion. Following the acquisition, Power Solutions will continue to operate under its existing brand, with no changes to the management team.

Dycom said the acquisition expands its presence in the fast-growing, mission-critical data center market. The deal is expected to close before the end of the current fiscal year.

Q3 Print

Separately, the company posted a 14% increase in third-quarter contract revenue to $1.45 billion on Wednesday, while its GAAP earnings per share (EPS) rose 35.4% to $3.63.

Non-GAAP adjusted earnings before interest, tax, depreciation and amortization (EBITDA) increased to $219.4 million, or 15.1% of contract revenues, compared to $170.7 million, or 13.4% of contract revenues, for the prior year quarter.

The company raised the midpoint of its full-year revenue forecast and now expects fiscal 2026 contract revenues of $5.35 billion to $5.43 billion, representing 13.8% to 15.4% growth compared with the previous corresponding period.

The stock was up 6.6% in premarket.

How Did Stocktwits Users React?

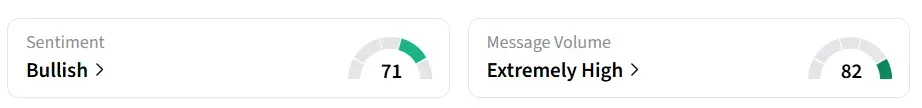

Retail sentiment on Stocktwits flipped to 'bullish' from 'bearish' a day earlier, amid 'extremely high' message volumes.

The stock has climbed 82% so far this year .

Get updates to this developing story directly on Stocktwits.

Also See: Why Are Lithium Stocks Gaining In Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)