Advertisement|Remove ads.

CRCL Stock Falls Below Its Listing Price Of $69

- CRCL stock had listed at a 122% premium over its issue price of $31.

- The shares fell despite the company’s Q3 print beating estimates last week.

- Despite the sharp decline over the past few sessions, retail sentiment on Stocktwits has remained ‘extremely bullish’ over the past 24 hours.

Circle (CRCL) stock declined 10% on Wednesday, falling just below its listing price of $69. In June, the company debuted at a 122% premium to its $31 issue price.

CRCL stock has been under heavy selling pressure, barely snapping a five-session losing streak on Tuesday.

Last week, Circle, which issues dollar-backed USD Coin (USDC), reported total revenue and reserve income of $740 million, topping analyst expectations of $699 million, according to Koyfin data. Earnings per share were $0.64, well above the consensus estimate of $0.20.

“In our view, CRCL is likely to see downward revisions to consensus estimates over the coming years amid declining rates, less stellar proliferation than many are hoping for of its USDC stablecoin, and growing costs to distribute the coin,” Mizuho said in a note last week, as reported by Barrons.

Cryptos Fall

Crypto markets have seen a downturn lately. On Wednesday, Bitcoin was down nearly 3% at $89,159.62, while Spot Bitcoin ETFs are on track for their weakest month on record.

More than $1 billion was wiped out from crypto markets in the previous session. On-chain analytics firm Glassnode noted that Bitcoin has fallen below its 0.75 cost-basis quantile, a level that has historically aligned with bear-market conditions.

How Did Stocktwits Users React?

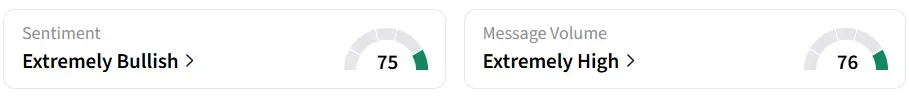

Despite the sharp decline over the past few sessions, retail sentiment on Stocktwits has remained ‘extremely bullish’ over the past 24 hours, amid ‘very high’ message volumes.

One user expects the stock to hit $150.

Volumes traded on Wednesday were nearly double its average. The stock has closed in the green in just four out of 12 sessions so far this month.

Also See: When Does Nvidia Report Q3 Earnings?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)