Advertisement|Remove ads.

KalVista Stock Soars Pre-Market On FDA Approval For Drug In Treating Swelling Disorder: Retail’s Elated

KalVista Pharmaceuticals, Inc. (KALV) on Monday said that the U.S. Food and Drug Administration (FDA) has approved its drug Ekterly for the treatment of acute attacks of hereditary angioedema in adults and children aged 12 years and older.

KalVista’s shares were up over 17% in pre-market trading.

Hereditary angioedema (HAE) is a rare genetic disease caused by deficiency or dysfunction of a protein called the C1 esterase inhibitor, where patients experience painful and debilitating attacks of tissue swelling in various locations of the body that can be life-threatening depending on the area affected.

Ekterly is the first and only oral on-demand treatment for HAE, KalVista said, setting it apart from other on-demand HAE treatment options approved in the U.S., which require intravenous or subcutaneous administration.

Even with the use of long-term prophylaxis as a preventative therapy, most people living with HAE continue to have unpredictable attacks and require on-demand access to medication, the company added.

KalVista will launch Ekterly in the U.S. immediately, and physicians can begin writing prescriptions on Monday.

The approval was based on results from a late-stage study in 136 patients, showing that Ekterly achieved significantly faster symptom relief, a reduction in attack severity, and an increase in attack resolution compared to the placebo. The results also showed that the drug was well-tolerated, with a safety profile similar to that of the placebo.

A later study also showed that Ekterly enabled patients to treat attacks in a median of 10 minutes following onset.

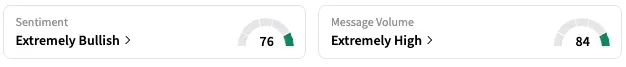

On Stocktwits, retail sentiment around KalVista jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours, while message volume rose from ‘high’ to ‘extremely high’ levels.

A Stocktwits user expressed optimism for the stock hitting as high as $50 upon the news.

KALV stock is up by over 41% this year and down by about 2% over the past 12 months.

Read Next: Shell Signals Earnings Dip In Trading In Q2, But Refining Margin To Improve

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_QR_OG_jpg_08610d948a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1230125578_jpg_85f30da0d4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1233729079_jpg_0ced7540cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)