Advertisement|Remove ads.

Keurig Dr Pepper Quenches Retail Investors’ Thirst For Earnings

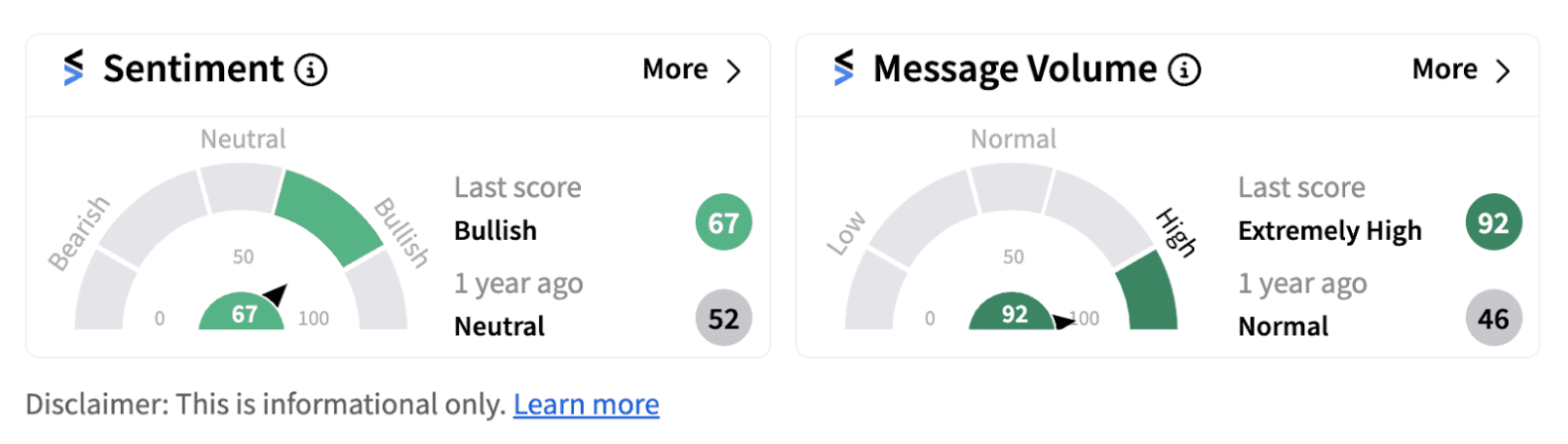

Beverage and coffeemaker conglomerate Keurig Dr Pepper announced its second-quarter results on Thursday with most metrics aligning with analyst estimates. Diluted earnings per share (EPS) came in at $0.45 while revenue stood at $3.92 billion, both in line with analyst estimates. Shares of the company traded over 2% higher on the news, with Stocktwits sentiment reaching a bullish zone (67/100) supported by extremely high message volume.

During the second quarter, adjusted operating income rose 11% to $970 million led by higher net price realization and net productivity. Operating margin stood at 24.70% for the period. Meanwhile, adjusted net income rose 3.20% year-over-year (YoY) to $618 million.

According to a CNBC report that cited Beverage Digest, Dr. Pepper recently surpassed Pepsi as the second-most consumed soda in the country.

From a segment perspective, the US refreshment beverages net sales grew 3.30% to $2.40 billion driven by net price realization of 2.90%. Adjusted operating income rose 11.90% to $723 million with a healthy operating margin of 30%. However, the US Coffee segment witnessed a 2.10% decline in its net sales to $1 billion. International net sales rose 15.50% to $0.6 billion.

CEO Tim Cofer stated that strong execution drove the company’s performance in the second quarter. “Now halfway through 2024, we are on track to achieve our unchanged full year outlook, while also seeding initiatives to fuel consistent growth over multiple years,” he said.

The company reaffirmed its fiscal 2024 guidance for constant currency net sales growth in a mid-single-digit range, also projecting adjusted diluted EPS growth in a high-single-digit range.

The year hasn’t been great for Keurig Dr Pepper stock with the shares basically flat YTD. Still, retail investors are betting on a rebound, citing pricing power and volume growth its competitors have been unable to achieve.

One Stocktwits user named ‘Morechumanthanhuman’ expressed bullishness on the stock and stated that shares of the beverage-maker could move back to 40 on the back of these results.

Photo Courtesy: Brandon Richardson on Pexels

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)