Advertisement|Remove ads.

Keurig Dr Pepper To Acquire Energy Drink-Maker Ghost For Nearly $1B: Retail Sentiment Inches Higher

Shares of beverage and coffeemaker conglomerate Keurig Dr Pepper ($KDP) were in focus on Thursday after the firm announced it will acquire energy drink-maker Ghost in a series of transactions.

KDP said it will initially purchase a 60% stake in GHOST, which will be followed by the acquisition of the remaining 40% stake in 2028.

Following the acquisition, GHOST will continue to be led by co-founders, Dan Lourenco and Ryan Hughes, and will operate as part of KDP's U.S. Refreshment Beverages segment, it added.

The first stage of the transaction includes KDP making an initial cash investment of approximately $990 million for a 60% stake in GHOST. In the second stage, KDP will purchase the outstanding 40% stake in 2028. This will happen at a pre-negotiated valuation scale that will reflect GHOST's 2027 financial performance.

Beginning mid-2025, KDP is looking to invest up to $250 million to transition GHOST Energy's existing distribution agreements before commencing the sale and distribution of the brand through the firm’s direct store delivery network.

KDP CEO Tim Cofer said GHOST is a differentiated brand with significant growth potential. “This acquisition strengthens our position in the attractive energy drink category, accelerating our portfolio evolution toward consumer-preferred, growth-accretive spaces through a disciplined deal structure,” he said.

KDP expects the transaction to be neutral to modestly accretive to its adjusted earnings per share (EPS) beginning 2025.

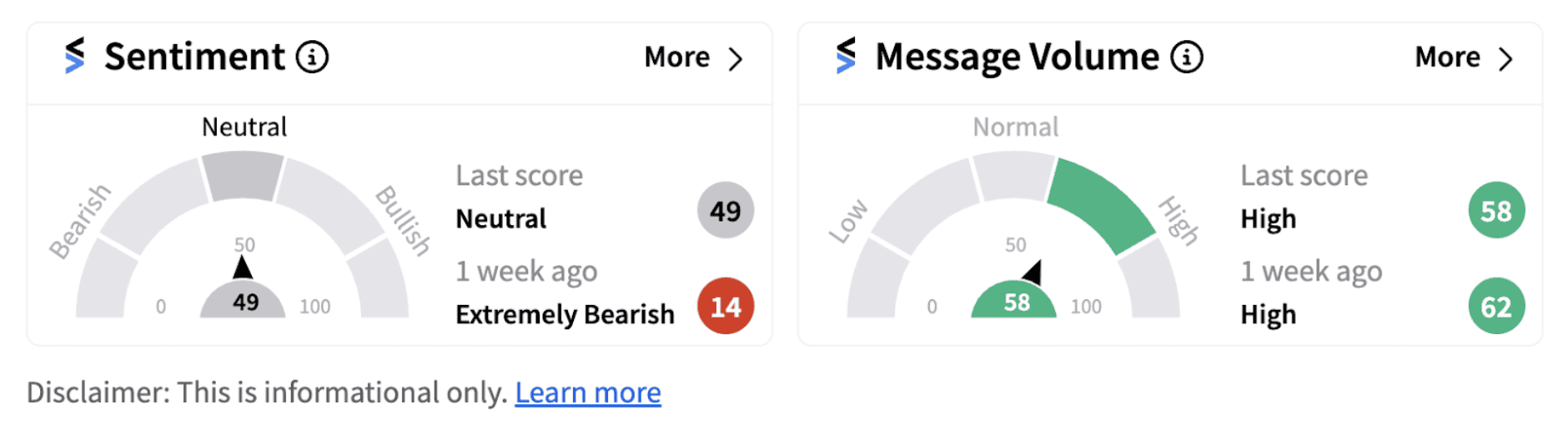

Following the announcement, retail sentiment on Stocktwits inched up into the ‘neutral’ territory (49/100) from ‘extremely bearish’ a day ago. The move was accompanied by high message volume.

Shares of KDP have gained nearly 10% since the beginning of the year.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)