Advertisement|Remove ads.

Kevin Hassett Leads Fed Chair Odds After Reportedly Saying He’d Be ‘Happy To Serve’, Trump Says His Mind Is Made Up

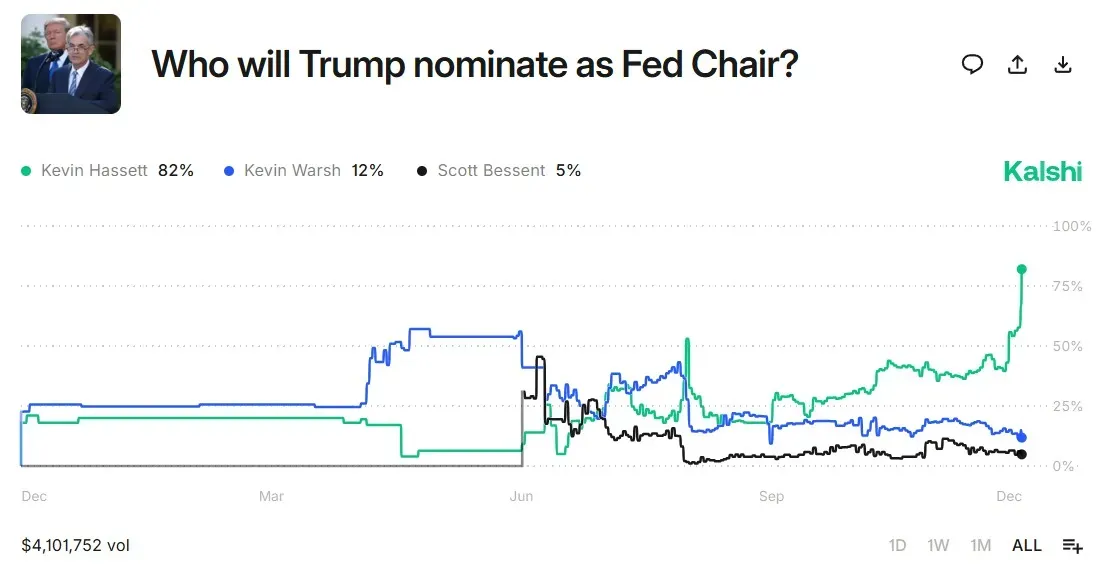

- Data from Kalshi shows that there is an 82% probability of Hassett emerging as the Fed Chair pick.

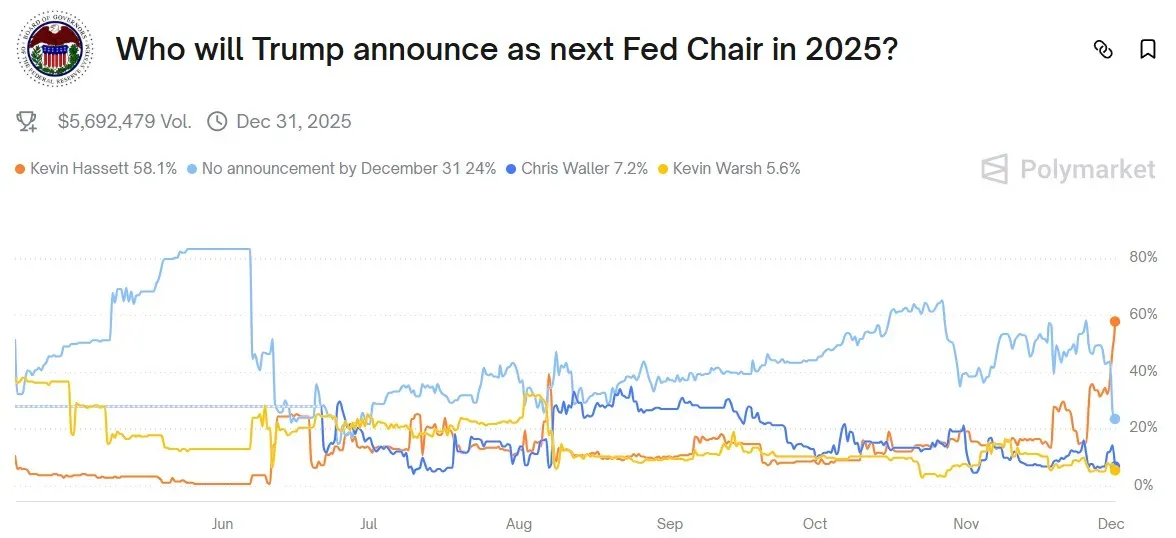

- Participants on Polymarket were slightly less optimistic, with data pointing to a 58% probability of Hassett being picked as the Fed Chair at the time of writing.

- Other potential picks include ex-Fed official Kevin Warsh, current central bank governor Christopher Waller, Fed Vice Chair for Supervision Michelle Bowman, and BlackRock’s Rick Rieder.

White House National Economic Council Director Kevin Hassett reportedly said on Sunday that he would be “happy to serve” as the next Federal Reserve Chair.

Hassett’s comments came in an interview with Fox, where he stated that once it became clear that President Donald Trump was inching closer to a decision, the U.S. equity markets “really celebrated,” interest rates declined, and the Treasury Department had one of its “best treasury auctions ever.”

“I think that the market expects that there's going to be a new person at the Fed, and they expect that President Trump's going to pick a new one. And if he picks me, I'd be happy to serve,” Hassett said in the interview.

A few hours later on Sunday, President Donald Trump told reporters aboard Air Force One that he had made up his mind about who his pick to lead the Fed is.

“I know who I am going to pick, yeah. We’ll be announcing it,” President Trump said, without naming the person in question.

What Are Prediction Markets Showing?

Data from Kalshi shows an 82% probability that Hassett will emerge as the Fed Chair pick. Participants on Polymarket were slightly less optimistic, with data indicating a 58% probability that Hassett would be picked as the Fed Chair at the time of writing.

Trump’s Potential Fed Chair Picks

Apart from Hassett, President Trump’s potential picks for the Fed Chair position include ex-Fed official Kevin Warsh, current central bank governor Christopher Waller, Fed Vice Chair for Supervision Michelle Bowman, and BlackRock Inc.’s Rick Rieder.

Treasury Secretary Scott Bessent had previously stated that there are 11 candidates in the list and that he would narrow it down before presenting it to President Trump.

Meanwhile, U.S. equities declined in Monday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down by 0.37%, the Invesco QQQ Trust ETF (QQQ) fell 0.57%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.24%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down by 0.41% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)