Advertisement|Remove ads.

Michael Burry Takes Aim At Musk’s Tesla Again, Says TSLA Stock Is Still ‘Ridiculously Overvalued’: Report

- Burry, who was among the first to call out the subprime mortgage crisis, has also disclosed bets against Nvidia and Palantir Technologies.

- This comes amid a decline in Tesla registrations in several key European markets in November.

Michael Burry on Sunday reportedly took aim at Tesla Inc. (TSLA), calling the electric vehicle giant “ridiculously overvalued.”

According to a Business Insider report citing Burry’s latest Substack post, the “Big Short” legend said Tesla’s market capitalization has been overvalued for a long time.

“As an aside, the Elon cult was all-in on electric cars until competition showed up, then all-in on autonomous driving until competition showed up, and now is all-in on robots — until competition shows up,” Burry said, according to the report.

Burry, who was among the first to call out the subprime mortgage crisis, has also disclosed bets against Nvidia Corp. (NVDA) and Palantir Technologies Inc. (PLTR).

Tesla shares were down by more than 1% in Monday’s opening trade. Retail sentiment on Stocktwits around the company trended in the ‘bullish’ territory at the time of writing.

Tesla’s Registrations In Europe

Tesla’s registrations in Europe declined in several key markets in the region in November. According to data compiled by Reuters, Tesla car registrations declined by 58% in France, 59% in Sweden, 49% in Denmark, and 44% in the Netherlands.

However, the company bucked the trend in Norway. Its sales rose 34.6% year-to-date to 28,606 cars in the country, eclipsing the previous record of 26,575 cars set by Volkswagen in 2016, the report added.

Tesla’s Optimus Humanoid Robot

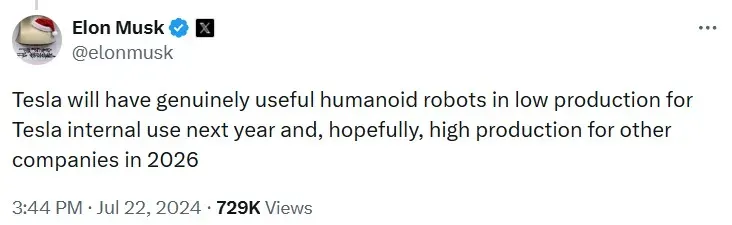

Tesla’s Optimus humanoid robot is currently under development. The company describes it as a general-purpose bipedal robot capable of performing unsafe, repetitive, or boring tasks.

Tesla announced Optimus in 2021, with CEO Elon Musk later stating in a post that the humanoid robot would be used internally by the EV giant by 2025. He envisioned production at a larger scale for other companies in 2026.

TSLA stock is up 7% year-to-date and 29% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)