Advertisement|Remove ads.

US Natural Gas Futures Slump, Sending KOLD ETF Soaring Pre-Market As Winter Demand Fades

- Benchmark U.S. natural gas futures at Henry Hub, expiring in March, sank nearly 16%.

- April contracts were down around 11.4% at $3.8 per MMBtu.

- ProShares Ultra Bloomberg Natural Gas (BOIL) declined 32% in pre-market trading.

U.S. natural gas futures crashed on Monday on reports of a warmer forecast for February, with a large part of the country expected to experience above-normal temperatures. A shift towards a warmer February has put ProShares UltraShort Bloomberg Natural Gas (KOLD) in the spotlight.

The National Oceanic and Atmospheric Administration (NOAA) has projected above-average temperatures across much of the country, according to a report by Bloomberg.

Last week, NOAA said the likelihood of above-normal temperatures increases farther west, with parts of the northern High Plains and areas stretching from the western Rockies to the Pacific Coast facing at least an 80% chance of warmer weather.

The benchmark U.S. natural gas futures at Henry Hub, expiring in March, have plummeted nearly 16% to $6.67 per million British thermal units (MMBtu) at the time of writing. April contracts were down around 11.4% at $3.8 per MMBtu.

ETF Watch

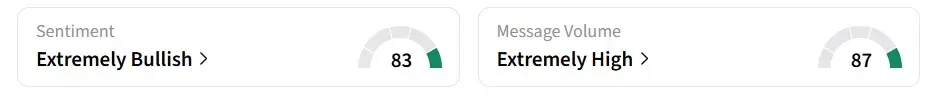

Meanwhile ProShares UltraShort Bloomberg Natural Gas (KOLD), an ETF that benefits from falling natural gas prices, surged more than 32% in pre-market trading to $18, and was among the top trending tickers on Stocktwits. Retail sentiment for KOLD on the platform remained ‘extremely bullish’ over the past 24 hours, amid ‘extremely high’ message volumes.

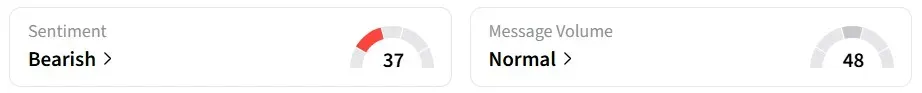

ProShares Ultra Bloomberg Natural Gas (BOIL) tanked 32% to $27.7, at the time of writing. Sentiment on the platform for BOIL turned ‘bearish’ from ‘neutral’ a session earlier.

Natural gas futures jumped to over three-year highs late in January as Winter Storm Fern gripped large parts of the U.S., resulting in power outages, including forced production shutdowns and tightened pipeline flows, particularly into the Eastern Seaboard. Natural gas futures had surged more than 30% to their highest levels since November 2022.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)