Advertisement|Remove ads.

Korn Ferry Stock Hit A Key Technical Milestone After 2 Months – What’s Driving The Rally?

- Korn Ferry posted a 7% increase in fee revenue to $721.7 million, beating Street estimates of $706 million.

- For the third quarter, the company expects fee revenue between $680 million and $694 million.

- Diluted EPS is estimated to come in between $1.15 and $1.21 next quarter.

Korn Ferry (KFY) shares jumped nearly 4% on Tuesday, breaking above the 50-day moving average for the first time in more than two months after the company delivered a stronger-than-expected second-quarter report.

KFY stock hit its 50-day moving average (50-DMA) for the first time since October 6, while rising to its highest levels since October 29.

Q2 Report Tops Estimates

The firm posted a 7% increase in fee revenue to $721.7 million, comfortably beating Street estimates of $706 million, according to Fiscal.ai. Net income rose 19% to $72.4 million, resulting in an earnings per share of $1.36. This surpassed an estimate of $1.31.

Net margin grew 100 basis points to 9%, while the adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) margin held steady at 17.3%. The company ended the quarter with an estimated $1.842 billion in remaining fees under contract, reflecting a 20% annual increase.

Business momentum was particularly strong in the Executive Search and Professional Search & Interim segments, where fee revenue grew 10% and 17%, respectively. The Consulting segment posted a 4% improvement, supported by a 10% rise in average bill rates.

The Digital segment saw a 2% decline in fee revenue but maintained an adjusted EBITDA margin of 31.6%. Recruitment Process Outsourcing delivered 4% growth, driven by new client wins in North America.

Korn Ferry issued its outlook for the third quarter of fiscal 2026, projecting fee revenue between $680 million and $694 million. The company expects diluted EPS to be between $1.15 and $1.21, with adjusted diluted EPS slightly higher at $1.19 to $1.25.

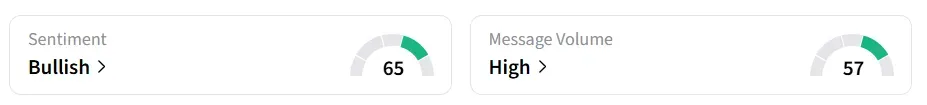

How Did Stocktwits Users React?

Retail sentiment for KFY on Stocktwits remained in the ‘bullish’ territory over the past 24 hours, accompanied by ‘high’ message volumes.

In 2025, the stock has declined 1.6%.

Read also: Silver Breaks Past $60 An Ounce For The First Time

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)