Advertisement|Remove ads.

Kura Sushi Gets A Wall Street Upgrade On ‘Solid’ Prospects, Retail's Mood Brightens

Shares of Kura Sushi USA Inc. (KRUS) were in focus on Friday as the company received an analyst upgrade, but retail sentiment was subdued.

Lake Street upgraded Kura Sushi to ‘Buy’ from ‘Hold’ with an unchanged price target of $103, based on its assessment and valuation as Kura’s shares sold off significantly since a "positive" first-quarter earnings report, The Fly reported.

According to the analyst, Kura shares are now at "a compelling entry point” and the company has a “solid growth story that can overcome many of the macro pressures due to its unique place in the restaurant industry," added the report.

Kura reported better-than-expected Q1 earnings, posting loss per share of $0.08 on revenues of $64.46 million compared to loss per share of $0.21 on $61.67 million that Wall Street analysts had quoted.

Kura’s comparable restaurant sales increased 1.8% from the year-ago period the same period in 2024.

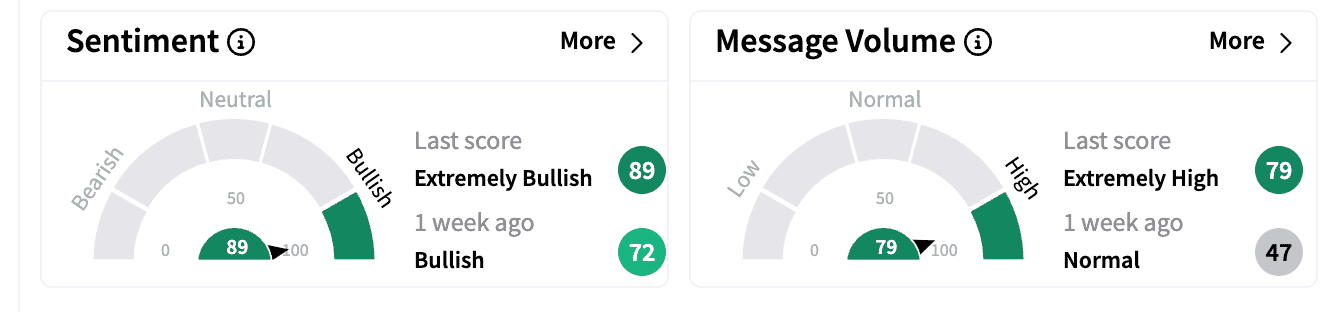

Retail sentiment on Stocktwits improved to ‘extremely bullish’ from ‘bullish.’ Message volumes were in the ‘extremely high’ zone compared to ‘normal.’

For the full fiscal year of 2025, Kura reiterated its annual guidance of total sales expected between $275 million and $279 million, at the higher end of the consensus analyst estimates of $279 million.

Kura Sushi operates a Japanese restaurant concept with 70 locations across 20 states and Washington D.C. It is a subsidiary of Kura Sushi Inc., a Japan-based revolving sushi chain with over 550 restaurants.

Kura stock is down 22.89% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239899916_jpg_cde8ab32f4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)