Advertisement|Remove ads.

BlackBerry Stock Rides ‘FOMO’ Rally To 16-Month High Following Cylance Divestment: Retail Turns Bullish

Shares of Waterloo, Ontario-based Blackberry Limited ($BB) are on track to extend their winning streak to three sessions, perking up retail sentiment.

Blackberry, a provider of intelligent software and services to enterprises and governments, announced late Monday that it has completed the divestment of its Cylance endpoint security assets to Arctic Wolf. The deal was announced on Dec. 15.

John Giamatteo, CEO of BlackBerry, said, “We are pleased to have successfully closed this pivotal transaction for BlackBerry and look forward to continuing our relationship with Arctic Wolf as a customer, as a reseller of the portfolio to our large government customers, and as a shareholder of this dynamic, growing company.”

BlackBerry stock climbed 7.2% on Tuesday after the announcement and nearly 10% on Wednesday before settling at the highest level since Sept. 22, 2023.

In premarket trading on Thursday, the stock rose 3.15% to $5.24, signaling that the upward momentum would likely gain strength.

The Cylance sale fetched Blackberry $160 million and gave the company a $55 million worth stake in Arctic Wolf.

While analysts are optimistic about the divestment, they are skeptical about Blackberry’s near-term fundamentals. TD Securities upped the price target for BlackBerry’s stock in mid-December, citing the Cylance divestiture, but caution regarding the automotive industry headwinds and a lack of near-term catalysts.

The full-year guidance issued in December calls for bottom-line results in the range of a loss of $0.02 to break even and revenue of $517 million to $526 million.

BlackBerry is counted among meme stocks as it participated in the meme stock frenzy that peaked in early 2021, primarily due to the high short interest. The stock has a huge following on the Stocktwits platform, underlining the strong retail interest in the stock.

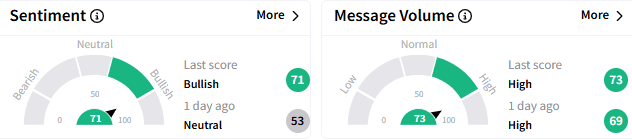

On Stocktwits, sentiment toward BlackBerry stock improved to ‘bullish’ (71/100) from the ‘neutral’ mood that prevailed a day ago. The message volume remained at ‘high’ levels.

A retail watcher pinned their hope on the FOMO rally kicking in.

Another user highlighted the gains of over 100% over the past year, while noting that the stock has broken out after a consolidation move that lasted for over six months.

BlackBerry’s stock has gained over 34% so far this year after it rose a modest 6.8% in 2024. The stock was among the top five trending tickers on Stocktwits early Thursday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2169625480_jpg_988055282a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261087084_jpg_9cdd1d104f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)