Advertisement|Remove ads.

Lam Research Stock Surges 6% On Upbeat Q1 Results: Retail Goes Gaga

Shares of Lam Research Corp. ($LRCX) rose sharply in pre-market trading on Thursday following the chip-equipment maker’s first-quarter earnings beat.

The Fremont, California-based company reported first-quarter non-GAAP earnings per share (EPS) of $0.86, higher than the year ago’s $0.69 (split adjusted) and the consensus of $0.80.

In May, the company announced a 10-for-1 stock split, with the corporate action taking effect on Oct. 2.

Quarterly revenue climbed about 20% year-over-year (YoY) from $3.48 billion to $4.17 billion. The top-line performance surpassed Wall Street’s forecast of $4.06 billion.

Non-GAAP gross margin came in at 48.2%, up from 47.9% reported a year ago. It, however, contracted slightly from the 48.5% reported for the previous quarter.

China accounted for a major share of Lam Research’s total revenue (37%), followed by Korea (18%), Taiwan (15%) and the U.S. (12%).

Looking ahead, the company expects second-quarter non-GAAP EPS at $0.87 and revenue of $4.30 billion. Analysts, on average, expect the company to report EPS of $0.84 and revenue of $4.24 billion, according to Yahoo Finance.

“These results marked the fifth consecutive quarter of revenue growth for the company,” said Timothy Archer on the earnings call, Motley Fool reported.

“When combined with our solid outlook for the December quarter, Lam's performance points to strong execution in an industry environment where NAND spending has yet to recover.”

Archer also hinted at artificial intelligence driving strong investments in leading-edge logic nodes as well as advanced packaging segments, including high bandwidth memory or HBM.

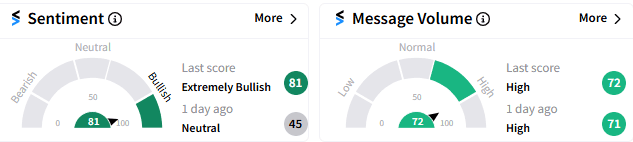

The strong results and positive guidance have cheered the retail crowd as the sentiment score on Stocktwits suggests ‘extreme bullishness’ (81/100) in premarket trading as of 7:40 am ET, accompanied by heavy message volume. This is an improvement from the neutral disposition a day ago.

Retail traders see the stock rallying to $90, up from its current level of $70.

As of 7:40 am ET, Lam Research stock was up 6.03% at $77.25.

Read Next: Tesla Stock Spikes On Q3 Earnings Beat But Retail Sentiment Remains Stubbornly Bearish

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)