Advertisement|Remove ads.

Tesla Stock Spikes On Q3 Earnings Beat But Retail Sentiment Remains Stubbornly Bearish

Tesla, Inc. ($TSLA), the frontrunner in the electric-vehicle industry, reported higher earnings, thanks to its cost-control efforts but top-line growth was anemic notwithstanding strong contribution from regulatory credits.

Key Numbers

The Texas-based company reported third-quarter non-GAAP earnings per share (EPS) of $0.72, beating the consensus estimate of $0.59. The EPS also bettered the year-ago’s $0.66 and second-quarter’s $0.52.

With the performance, Tesla snapped a two-quarter profit decline streak.

Revenue climbed 8% year-over-year (YoY) from $23.35 billion to $25.18 billion. Sequentially, the top-line saw a slight dip from $25.50 billion reported for the second quarter. The third-quarter revenue came in shy of the consensus estimate of $25.47 billion.

Energy generation and storage revenue, though rising 52% from a year-ago, declined 21.17% sequentially to $2.38 billion.

The company attributed the YoY top-line growth to increased vehicle deliveries, higher energy segment revenue, higher full self-driving revenue recognition and higher regulatory credit, partially offset by lower average selling prices for its EVs.

The high-margin regulatory credits came in at $739 million, which marked the second-highest number ever for the company.

The Elon Musk-led company said its cost of goods sold fell to its lowest ever to $35,100.

Cash Position

Tesla, which operates in a capital-intensive industry, ended the third quarter with cash equivalents and investments of $33.6 billion. The company generated operating cash flow of $6.3 billion and free cash flow of $2.7 billion in the third quarter.

The Outlook

Looking ahead, Tesla expects to achieve slight growth in vehicle deliveries in 2024. To clock growth over the 1.81 million units delivered in 2023, the company has the tall order of selling 514,925 EVs in the fourth quarter.

It expects energy deployments to more than double YoY in 2024.

Tesla said plans for new vehicles, including more affordable models using the next-generation platform as well as some aspects of its current platform, remain on track for start of production in the first half of 2025.

The earnings release did not divulge any new information on robotaxis except for what was announced at the October 10 “We, Robot” event.

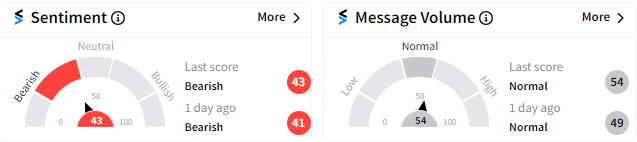

The retail crowd remains bearish despite Tesla’s fairly strong quarterly results. On Stocktwits, the sentiment score was at 43/100 as of 5:03 pm ET, which translates to ‘bearish’ sentiment. Message volume remains in normal territory.

Tesla’s anemic growth has not gone down well with some retail traders.

The focus now shifts to the earnings call scheduled for 5:30 pm ET to be hosted by Musk and his management team.

In after-hours trading at 5:03 pm ET, the stock climbed 8.90% at $232.67 following the earnings release. It is, however, well off its all-time closing high of $409.97 reached on November 3, 2021 and its year-to-date (YTD) high near $272.

Read Next: QQQ Slides As ‘Mag 7’ Stocks Sink Amid Rising Bond Yields: Retail Shifts To Neutral

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)