Advertisement|Remove ads.

What’s Behind Laser Photonics' Stock Rise Today?

- The company’s recently filed 10-Q filing satisfied Nasdaq’s quarterly reporting requirement.

- The company failed to report its results for the quarter ended Sept. 30 in a timely manner, resulting in noncompliance with Nasdaq's Listing Rules.

- The company filed its third quarter earnings report last week, posting a 28% jump in revenue for the period.

Laser Photonics shares (LASE) jumped more than 3% in premarket trading on Wednesday after it regained compliance with Nasdaq listing rule 5250(c)(1) regarding the timely filing of periodic reports.

The Nasdaq Stock Market confirmed that the company's December 23 filing of its Form 10-Q for the quarter ended September 30, 2025, satisfied the quarterly reporting requirement. Nasdaq has closed the related compliance matter.

The company received a notice from Nasdaq’s listing qualifications department in November stating that, because it had not received Laser Photonics’ Form 10-Q for the period ended September 30, 2025, it does not comply with Nasdaq's Listing Rules for continued listing.

Nasdaq had stated that the company has until January 19, 2026, to submit a plan to regain compliance with respect to the delinquent report.

Nasdaq may grant an exception to allow the company to regain compliance for up to a maximum of 180 calendar days from the Form 10-Q due date.

Q3 Results

The company last week filed its third quarter (Q3) earnings report, which showed a 28% jump in total revenue to $0.9 million, up from $0.7 million the year-ago period.

"Our Q3 report was impacted by a number of expense items and when combined with acquiring Beamer, caused us to be late with our quarterly filing. As this is now resolved, we expect to be back in compliance with Nasdaq imminently,” Carlos Sardinas, Chief Financial Officer of Laser Photonics, said.

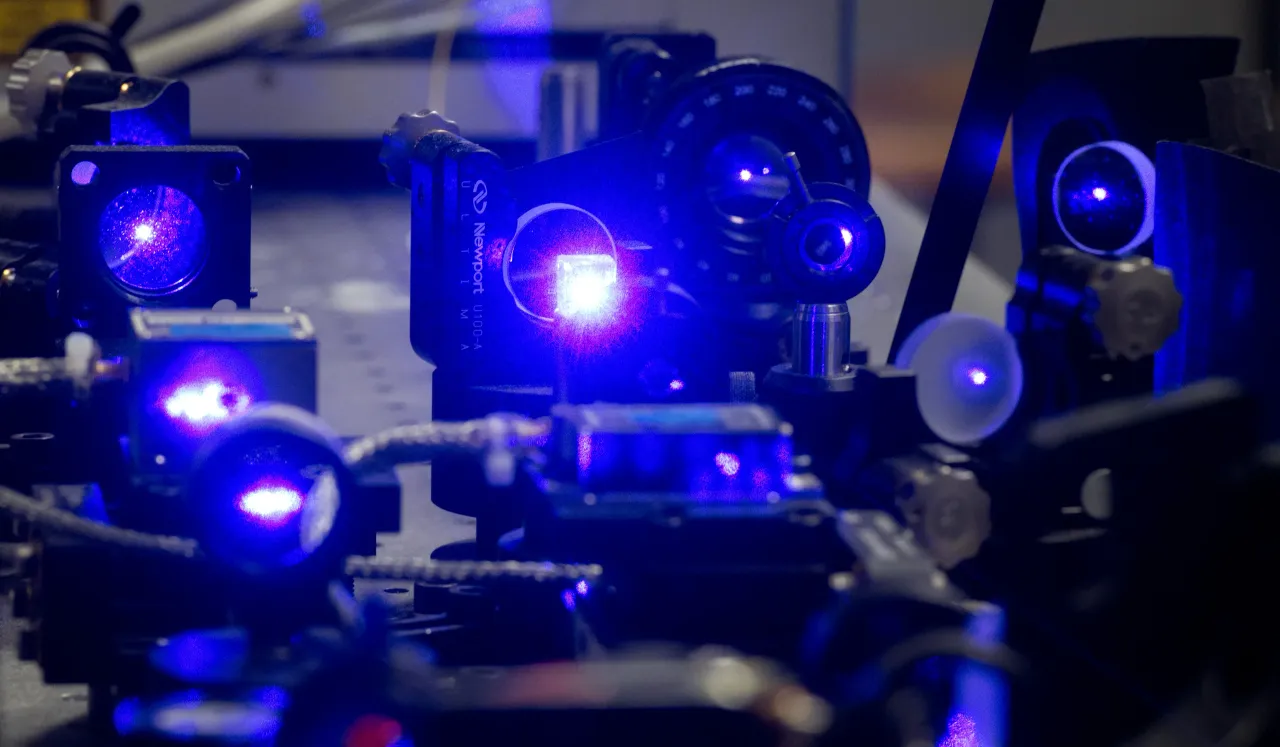

The Orlando-based company develops industrial laser systems for cleaning and material processing applications. The company has expanded its operations through acquisitions of Beamer Laser Systems and Control Micro Systems, broadening its capabilities into pharmaceutical and semiconductor manufacturing markets.

How Did Stocktwits Users React?

Retail sentiment around LASE trended in “bearish’ territory amid “low” message volumes.

Shares in Laser Photonics have fallen 61% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tilray_logo_resized_c5047aab55.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)