Advertisement|Remove ads.

Lucid Group Stock Slides on $860M Share Offering, Gloomy Outlook: Retail Still Betting On A Rebound

Shares of EV maker Lucid Group, Inc. ($LCID) dropped over 15% in pre-market trading on Thursday after the company announced a public offering, although retail sentiment remained resilient.

The company plans to sell 262.4 million common shares, valued at around $860 million based on Wednesday’s closing price.

In a separate regulatory filing, Lucid also projected a Q3 operating loss between $765 million and $790 million, higher than analysts’ expectations of $752 million.

However, the company expects Q3 revenue of $199-$200 million, slightly above the consensus estimate of $196 million.

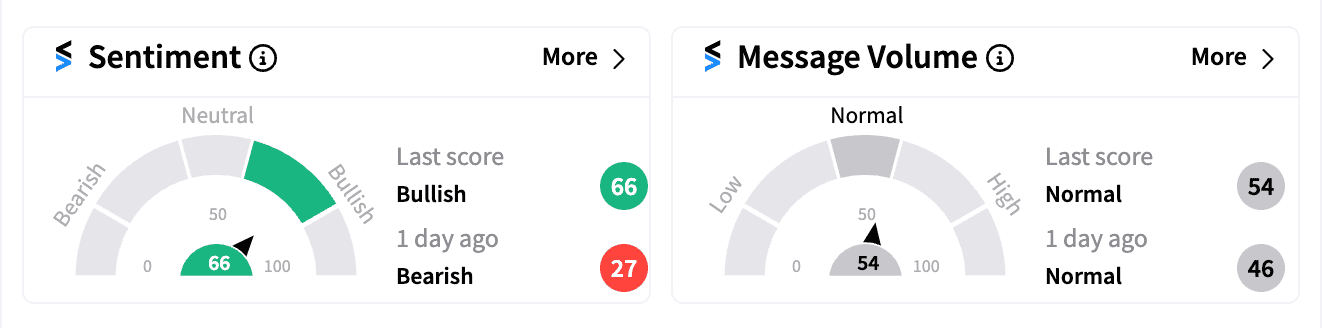

Despite the news, retail sentiment on Stocktwits remained ‘bullish’ early Thursday.

One user cited Saudi Arabia’s backing of Lucid, while others dismissed concerns over dilution, viewing the dip as a buying opportunity.

Lucid’s share offering follows a recent $1.5 billion capital injection from the Public Investment Fund (PIF) affiliate, Ayar Third Investment Company.

Ayar, Lucid’s largest shareholder, will buy 374.7 million shares in a private placement to maintain its 58.8% ownership stake.

Lucid is set to report Q3 earnings on Nov. 7. As of Sept. 30, the company held about $5.16 billion in liquidity, including $4.027 billion in cash.

It has a long-term debt of about a billion dollars.

Last week, Lucid reported stronger-than-expected Q3 deliveries of 2,781 vehicles but produced just 1,805 EVs, missing estimates.

The company currently sells only one model, the Lucid Air. In September it showcased its upcoming Gravity SUV and also teased some midsize vehicles that are expected to come with a starting price tag of $50,000.

Lucid shares have fallen 22% year-to-date, underperforming the broader S&P 500 index.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_elonmusk_OG_jpg_0752af8e37.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_old_White_House_c2cba4ca94.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Space_X_Elon_Musk_jpg_b27208e213.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_model_y_jpg_2fd46dbfb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_humana_resized_jpg_e2c016ee03.webp)