Advertisement|Remove ads.

Humana Stock Slips Premarket After Hitting 9-Year Low: Morgan Stanley Sees Medicare Advantage Risk In 2027

- Morgan Stanley flagged a new Medicare Advantage policy overhang, saying Humana’s "disproportionate" exposure could pressure margins into 2027.

- The firm cut Humana to 'Underweight' and lowered its price target to $174.

- Analysts had warned that the CMS rate update could weigh broadly on health insurers.

Shares of Humana, Inc. fell nearly 0.3% in premarket trading on Tuesday after a Morgan Stanley downgrade flagged Medicare Advantage policy risks into 2027.

The stock fell more than 4% on Monday, touching its lowest level in nine years, and slid a further 0.2% in extended trading.

Medicare Advantage Policy Overhang

Morgan Stanley said Humana faces a new “policy overhang” following what it described as an unfavorable Medicare Advantage Advance Rate Notice. The firm said the sector was “caught off-guard” by the update, which points to a roughly flat benchmark reimbursement rate for Medicare Advantage plans, well below consensus expectations for 3% to 5% growth.

The brokerage added that Humana is “disproportionately exposed” to Medicare Advantage, where the policy backdrop could slow Humana’s margin turnaround strategy. The firm also flagged “incremental risks” linked to Medicare Advantage enrollment growth and profitability this year.

Morgan Stanley downgraded Humana to ‘Underweight’ from ‘Equal Weight’ and lowered its price target to $174 from $262, implying a 7% downside from current levels.

Government Rate Proposal In Focus

The downgrade comes after the Centers for Medicare & Medicaid Services said last week that the U.S. has proposed an average 0.09% rate increase for payments to private insurers for the Medicare Advantage plans they manage in 2027. The agency said the update reflects underlying cost trends, 2026 quality ratings, and changes to the risk adjustment model, under which insurers are paid more when their patients are sicker.

“These proposed payment policies are about making sure Medicare Advantage works better for the people it serves,” CMS Administrator Mehmet Oz said, adding that the agency aims to modernize risk adjustment and protect taxpayers from unnecessary spending.

CMS said it expects the 0.09% increase to result in more than $700 million in additional payments in 2027. The agency is scheduled to issue the final Medicare Advantage rate announcement on April 6.

Analysts Warn Of Broader Sector Pressure

Cantor Fitzgerald said last week that healthcare insurance stocks could face a materially negative reaction following the Medicare Advantage rate update.

The firm said a quick rebound across the sector appears unlikely, as the rate outlook indicates greater political influence than in prior years. Cantor added that CMS’s proposal implies Medicare Advantage plans would receive only about $700 million more in 2027 compared with the current year.

How Did Stocktwits Users React?

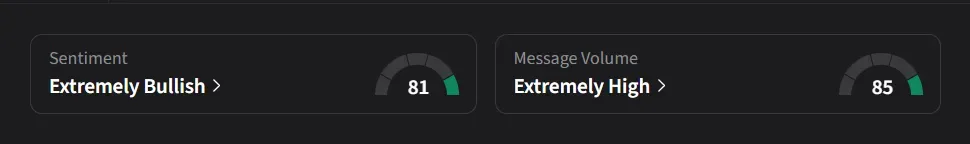

On Stocktwits, retail sentiment for Humana was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user expects the stock to fall to “$170 by Friday unfortunately.”

Another user said they plan to stay on the sidelines until at least two days after the earnings release, which is due next week on Feb.11.

Humana’s stock has declined 35% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)