Advertisement|Remove ads.

Lucid Stock Jumps After-Hours On Q4 Beat, Bold Delivery Targets: Retail Embraces CEO Transition

Shares of Lucid Group, Inc. surged more than 9.5% in Tuesday's extended session after the electric vehicle maker posted better-than-expected fourth-quarter results and announced a leadership shake-up that has been well received by investors.

Lucid reported an adjusted loss per share of $0.22 for Q4, narrower than Wall Street's anticipated loss of $0.25. Revenue came in at $234.5 million, exceeding analyst estimates of $214.1 million.

The company ended the quarter with approximately $6.13 billion in total liquidity.

Lucid produced 3,386 vehicles in the fourth quarter and 9,029 cars for the entire year, slightly above its annual production guidance.

Deliveries rose sharply, with 3,099 cars delivered in the final quarter of 2024, reflecting a 79% increase from a year earlier. Deliveries totaled 10,241 vehicles for the full year, up 71% compared to 2023.

Looking ahead, Lucid projected 2025 production of about 20,000 vehicles, a target that, if achieved, would mark a more than 120% increase from the previous year.

The most unexpected development from Lucid's earnings release was a leadership transition.

CEO Peter Rawlinson announced that he would step down from his role and transition to a newly created position as Strategic Technical Advisor to the Chairman of the Board. Chief Operating Officer Marc Winterhoff has been appointed as interim CEO.

Rawlinson, who has led Lucid for 12 years, said he was proud of the company's progress "from a tiny company with a big ambition to a widely recognized technological world leader in sustainable mobility."

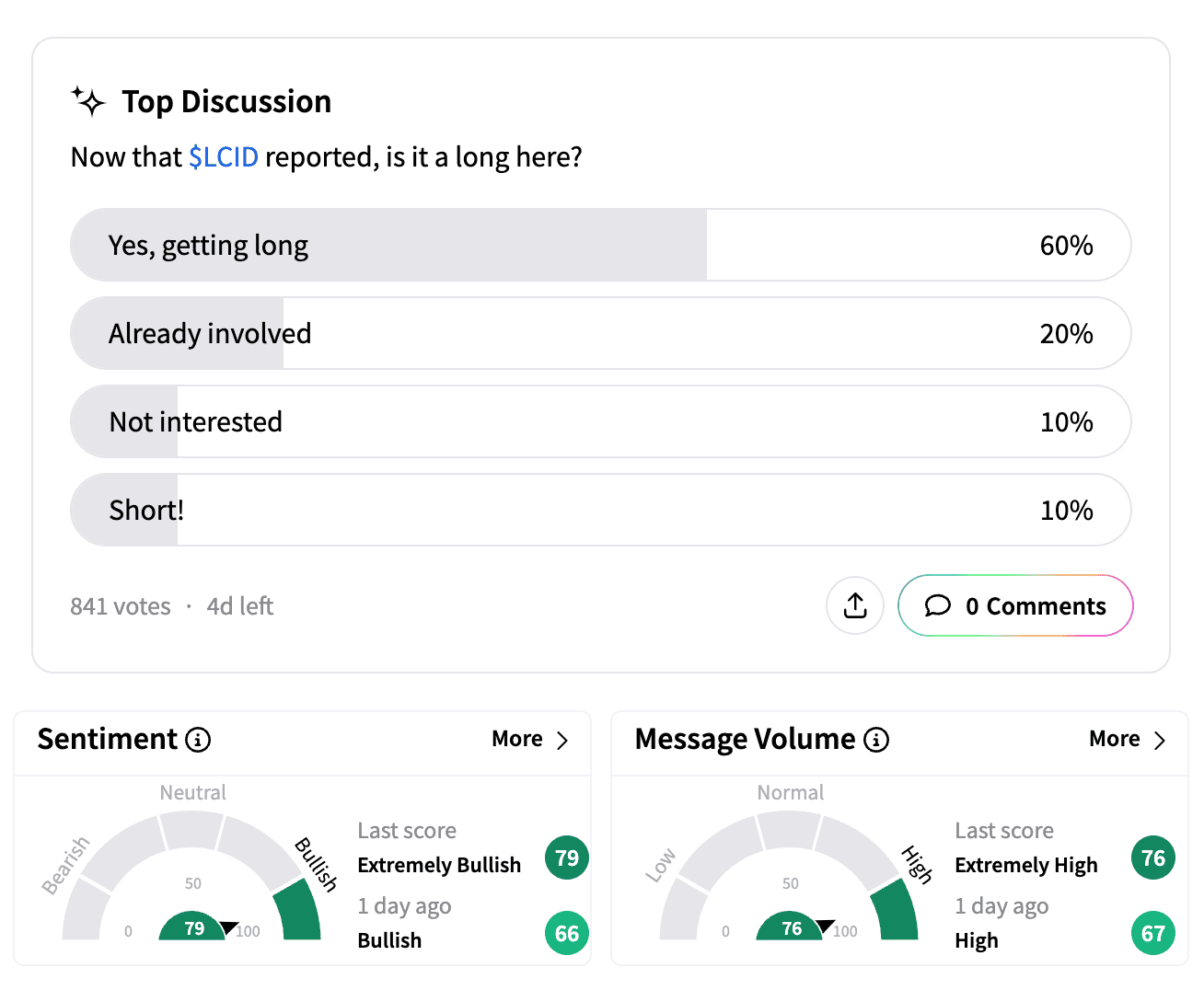

Investor sentiment on Stocktwits surged into 'extremely bullish' territory, reaching its highest level in a month amid a spike in message activity and trading volume.

Many retail investors expressed optimism about the company's improving financial performance and aggressive 2025 production targets.

Some viewed Rawlinson's move into a more technically focused role as a strategic decision allowing the company to strengthen its operational leadership.

Still, Wall Street has some concerns about Lucid's long-term prospects. On Monday, Redburn Atlantic downgraded the stock to 'Sell' from 'Neutral,' citing concerns over long-term cash outflows and the likelihood of future capital raises.

The company’s cash and cash equivalents stood at $1.6 million as of Dec. 31, 2024, compared to $1.36 million a year ago.

Lucid's stock has lost more than 13% in 2025 and has declined over 73% since going public in 2020 via a reverse merger with a blank-check firm.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)