Advertisement|Remove ads.

Lucid Gets A 'Sell' Rating On Wall Street Ahead Of Q4 Earnings, But Retail Isn't Letting Go Just Yet

Shares of Lucid Group, Inc. have fallen 16% over the past week as investors brace for the company's fourth-quarter earnings report, set for release after the market close on Tuesday.

Adding to the pressure, Redburn Atlantic on Monday reportedly downgraded Lucid to 'Sell' from 'Neutral,' slashing its price target to $1.13 from $3.50, citing concerns over its long-term cash outflows and capital needs.

According to The Fly, Redburn analyst Tobias Beith acknowledged Lucid's technological edge, noting that its peers may struggle to match its vehicle efficiency before 2030.

However, he emphasized that for this advantage to translate into financial stability, production volumes must ramp up sharply when Lucid's mid-sized platform launches in the second half of 2026.

The research firm estimates that Lucid's cumulative free cash flow gap versus consensus projections through fiscal 2023 is $11 billion, a discrepancy that could signal the need for significant additional capital later on.

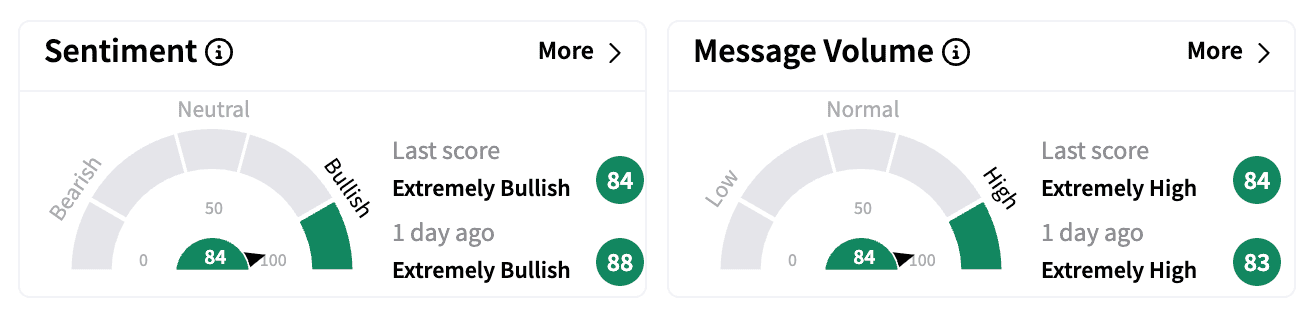

Despite the downgrade, retail sentiment on Stocktwits remains 'bullish,' though slightly lower than a week ago. Many investors appear unfazed by the stock's decline, viewing the dip as a long-term buying opportunity.

One user remarked that holding at least 100 shares at these levels for five years or more seemed reasonable, noting that Lucid vehicles are becoming a more frequent sight in Austin, Texas.

Another trader dismissed Monday's fall following the downgrade as a technical move, predicting that Lucid's earlier breakout near the $2.78 level would hold.

While most of Wall Street remains skeptical, Lucid secured its only 'Buy' rating earlier this month. The bullish analyst argued that Lucid's technology, balance sheet, and backing from Saudi Arabia's sovereign wealth fund position it well to capture a meaningful share of the EV market in the coming years.

However, the company continues to grapple with significant per-vehicle losses and ongoing cost-cutting efforts, including workforce reductions. Analysts expect Lucid to report a fourth-quarter adjusted loss per share of $0.26 on revenue of $212.2 million.

Shares of Lucid are down more than 8% so far in 2025, with earnings likely to set the tone for its near-term trajectory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)