Advertisement. Remove ads.

LendingClub Stock In Focus Ahead of Q3 Earnings: Retail Cautious

LendingClub Corp ($LC) stock was trading higher by 1% as of 7:46 am in pre-market trading on Wednesday ahead of the company’s third quarter-earnings release, with retail sentiment remaining cautious.

San Francisco-based LendingClub, which operates as a digital marketplace bank, will report its earnings on Wednesday.

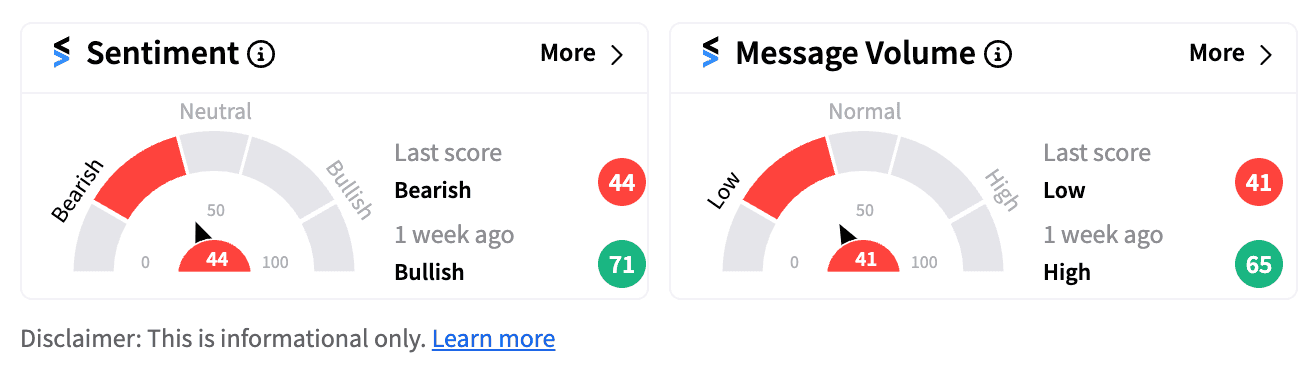

Retail sentiment on the stock has turned ‘bearish’ (44/100) from ‘bullish’ (71/100) a week ago, with message volumes dipping from ‘high’ (65/100) to ‘low’ (41/100).

Wall Street estimates earnings per share (EPS) to come in at $0.07 on revenues of $190.04 million.

Earlier this month, Keefe, Bruyette & Woods upgraded its rating on the firm to “market perform” from “outperform” while raising the price target to $15 from $11.50. Keefe noted that lower rates and a better macro environment "should be about to turn the party up a few notches," resulting in positive earnings revisions, according to The Fly.

Last quarter, the firm posted $0.13 in EPS, beating consensus estimates of $0.04. Its revenues came in at $187.24 million, 5.77% above from the consensus estimated by analysts.

Stocktwits users were upbeat on LendingClub’s prospects. The firm’s stock has more than doubled in value in the past year.

The stock is up 43.19% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/10/biogas.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/air-india-a350-900-2024-11-2a018689c22e8e313593c4b76845dbc8.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/swiggy-zomato-2024-11-abc7dc409c45ae64aa63306af7904262.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/shutterstock-2162617539-2025-08-b6396e634f55857935c2208abb72fdf6-scaled.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/piramal-aranya-arav-2025-01-9ca6001c2614d6f431d1dde76b7bdeeb.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/adani.jpg)