Advertisement|Remove ads.

Leslie’s Stock Falls On Lower EPS Guidance, Mixed Q1 Earnings, But Retail's Optimistic

Shares of Leslie’s Inc. ($LESL) fell more than 11% in after-hours trading on Thursday after the company reported mixed first-quarter results, but retail sentiment remained optimistic.

The company’s loss per share (EPS) came in at $0.22, higher than an analyst estimates of $0.21.

Revenue rose 0.7% to $175.23 million, beating estimates of $173.4 million. Adjusted net loss came in at $41.3 million compared to a loss of $36.8 million in the prior year period.

Jason McDonell, CEO of Leslie’s, said,” "We met our revenue expectations for our first quarter of fiscal 2025, reporting our first comparable store sales gain in two years. We saw a number of key categories improve both sequentially and year-over-year. The smaller contributing fiscal first quarter results in an associated loss and is typical for our seasonal business. This is a key time as we invest during our offseason and build inventory to prepare to win the pool season and deliver growth during our meaningful third and fourth fiscal quarters.”

For FY25, Leslie’s expects EPS to be a loss per share of $0.01 to earnings per share of $0.07, below consensus estimates of $0.11 . FY25 revenue is expected between $1.3 billion and $1.37 billion. That compares to consensus estimates of $1.36 billion, Fly.com reported.

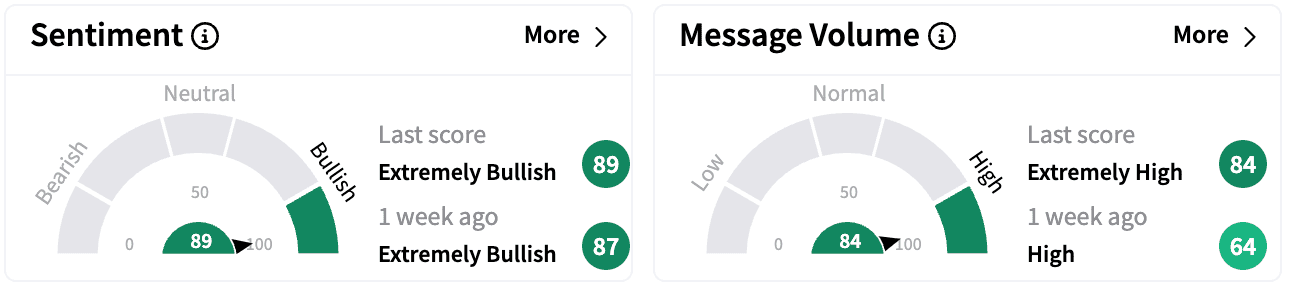

Sentiment on Stocktwits rose further into the ‘extremely bullish’ territory. Message volumes also rose to ‘extremely high’ from ‘high’ a week ago.

LESL sentiment meter and message volumes on Feb 6

One Stocktwits commenter was optimistic about the company’s transformation efforts.

Leslie’s is a direct-to-customer brand in the U.S. pool and spa care industry serving residential customers and pool professionals.

Leslie’s stock is down 0.45% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)