Advertisement|Remove ads.

Leslie's Stock Slips After Losing Spot In S&P SmallCap 600, Retail Sentiment Turns Bearish

Shares of Leslie's Inc. (LESL) dropped over 5% in after-hours trading Wednesday after news of its removal from the S&P SmallCap 600 index dampened retail sentiment.

SanDisk (SNDK) will replace Leslie's in the index before trading opens on Tuesday, Feb. 25. According to The Fly, Western Digital Corp. (WDC), an S&P 500 member, is spinning off SanDisk in a deal set to close on Feb. 24.

Western Digital will remain in the S&P 500 post-spin-off, while Leslie's market capitalization was deemed no longer "representative of the small-cap market space."

On Wednesday, Stifel analyst W. Andrew Carter reportedly cut Leslie's price target to $1.30 from $1.55, maintaining a 'Sell' rating. Carter noted that the company needs a significant second-half rebound but has "limited room for error."

On Tuesday, BofA double downgraded Leslie's to 'Underperform' from 'Buy,' slashing its price target to $1.40 from $2.65. The firm cited market share losses, weak FY25 guidance, and subdued free cash flow.

Leslie's reported mixed Q1 results this month, with a loss per share (EPS) of $0.22, slightly missing estimates of $0.21. Revenue rose 0.7% to $175.23 million, beating forecasts of $173.4 million. Adjusted net loss widened to $41.3 million from $36.8 million a year ago.

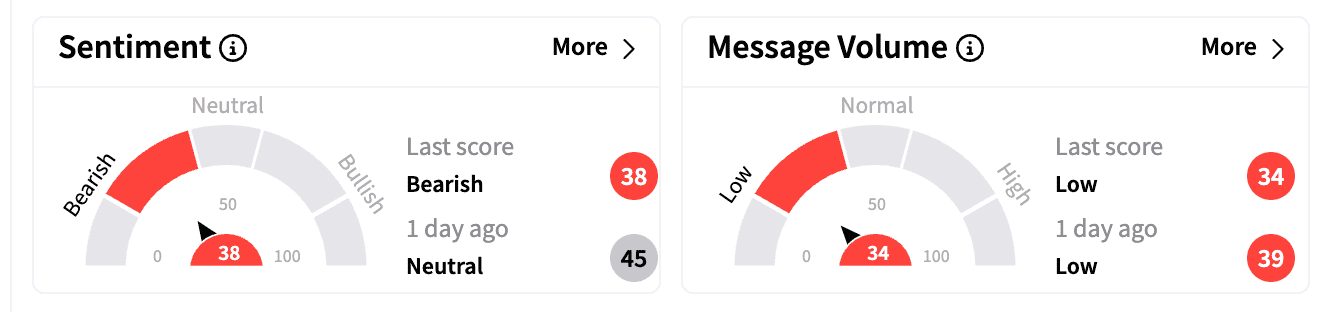

On Stocktwits, sentiment turned 'bearish' from 'neutral' just a day ago, with message volume remaining low.

Leslie’s is a direct-to-customer brand in the U.S. pool and spa care industry serving residential customers and pool professionals.

Leslie’s stock is down 0.45% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)