Advertisement|Remove ads.

Levi's Q3 Earnings Preview: Analysts Bullish, Some Expect Outlook Raise As Jeans Sell Like Hot Cakes

Analysts and retail investors expect Levi Strauss & Co. to easily beat its Wall Street sales and profit projections for the third quarter, amid sustained momentum in the business. The denim brand is scheduled to report its results after the market closes on Thursday.

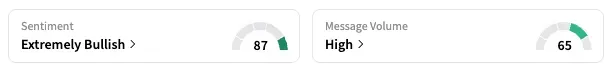

On Stocktwits, the retail sentiment for LEVI shifted to 'extremely bullish' as of early Thursday, from 'bullish' the previous day.

Levi's sales are likely to top its outlook, and the company could raise its full-year earnings forecast, BofA Securities said in an investor note earlier this week.

BofA, which maintained its 'Buy' rating on the company's shares, said denim remains a "hot" category across brands and retailers, and a strong back-to-school season bodes well for the company's results and guidance.

Brokerages such as Stifel, Citi, and Barclays raised their price target on LEVI in recent weeks, as also noted by this Stocktwits user. Last month, Needham started coverage on the stock with a 'Buy' rating, saying that the company's "conservative" second-half 2025 outlook creates a "favorable beat-and-raise setup."

Notably, Levi shares have gained sharply, rising nearly 29% since their recent low on Aug. 1.

Analysts expect Levi's Q3 sales to fall 1.2%, which would mark the second quarterly contraction in this fiscal year, and adjusted EPS to decline 2.3%, according to Koyfin data.

Currently, 10 of the 13 analysts covering the stock have a 'Buy' or higher rating, and three rate it 'Hold,' according to Koyfin. Their average target price of $25 is just above the stock's last close.

As of the last close, Levi shares have risen 42.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)