Advertisement|Remove ads.

Lifeward Appoints Mark Grant As New CEO: Retail Sentiment Dips

Nasdaq-listed shares of medical technology company Lifeward (LFWD) fell by about 2% on Monday afternoon after the company announced that Mark Grant was appointed its new President and CEO.

The new appointment will be effective June 2, and Grant will replace Larry Jasinski. To help with the transition, Jasinski will serve as co-CEO and in an advisory capacity until June.

Lifeward said he will continue in an advisory capacity on an as-needed basis until the end of 2025.

Grant previously worked with Bristol Myers Squibb, FLA Orthopedics, and health tech company Medtronic.

Most recently, Grant was President of the Americas and Chief Commercial Officer of IMRA Surgical, a provider of surgical robotic training.

The company said that the Board of Directors has approved an inducement award of 400,000 options to purchase ordinary shares of Lifeward for Grant.

The award will be made on the date he joins the company and vests in four equal annual installments beginning on the first anniversary of the new CEO’s joining date, subject to his continued employment with the company.

Lifeward designs, develops, and commercializes solutions for individuals with physical limitations or disabilities, including the ReWalk Exoskeleton, the AlterG Anti-Gravity system, the MyoCycle FES System, and the ReStore Exo-Suit.

The company recently launched the ReWalk 7, the newest generation of personal exoskeleton, in the U.S. market following FDA clearance in March.

Earlier this month, Lifeward reported an adjusted net loss of $4.6 million, or $0.44 per share, in the first quarter of 2025, compared to a loss of $5.3 million, or $0.62 per share, during the first quarter of 2024. The company’s revenue for the three months through the end of March was $5 million.

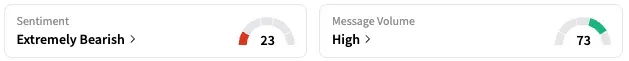

On Stocktwits, retail sentiment around Lifeward fell from ‘bearish’ to ‘extremely bearish’ territory over the past 24 hours while message volume remained at ‘high’ levels.

LFWD stock is down by 43% this year and over 74% over the past 12 months.

Also See: Netflix Stock Edges Lower After JPMorgan Downgrade Despite Higher Price Target

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)