Advertisement|Remove ads.

Lifeway Foods Stock's Retail Followers Stay Bearish After Q4 Earnings Miss

Shares of Lifeway Foods Inc. fell nearly 2% on Friday after the supplier of kefir and fermented probiotic products posted a fiscal fourth quarter results miss, with retail sentiment staying downbeat.

Lifeway Foods’ loss per share came in at $0.01, missing earnings per share estimates of $0.29, Investing.com reported. Revenue stood at $46.93 million versus the consensus estimate of $51.75 million.

"I am pleased to report another record year of net sales for Lifeway, spearheaded by the continued, strong volume growth of our flagship drinkable Lifeway Kefir," said Julie Smolyansky, Lifeway's president and CEO.

"After an extremely successful year in 2023 where we saw sales grow by more than 13%, that growth accelerated in 2024 during which Lifeway delivered further year-over-year growth of 17% to achieve annual net sales of $186.8 million.

"The consumer focus on health and wellness continues to grow, and we remain focused on capitalizing on that heightened interest,” Smolyansky said, noting the company is strategically investing this year to further boost growth.

Among the growth measures are plans for upgrades at its Waukesha plant, expected to almost double its production capacity and more than tripling its bottling speed, the company said.

It is also making efforts to boost operational efficiency and improve production capabilities, investing in key product lines and expand its brand awareness.

“2024 was an excellent year for Lifeway, and I am confident that we are extremely well positioned to deliver another phenomenal performance in 2025," Smolyansky said.

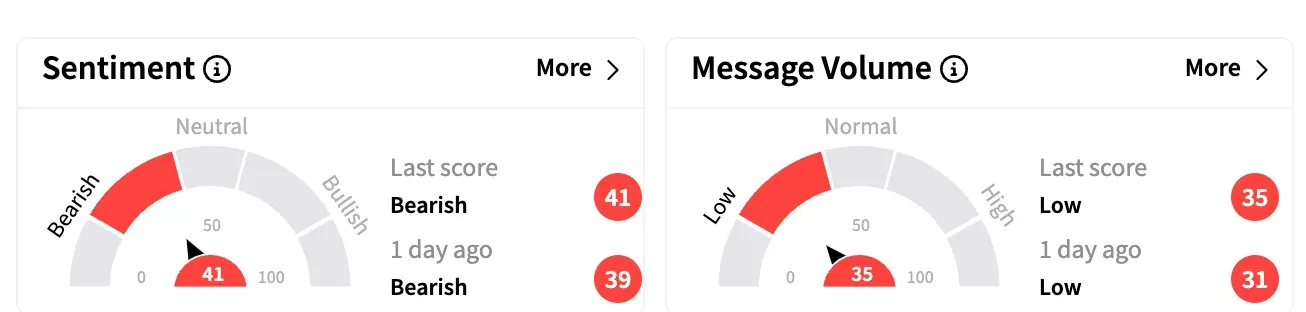

Sentiment on Stocktwits inched up in the ‘bearish’ zone on Friday. Message volume remained in the low zone.

For 2027, Lifeway said it was “on track” to deliver adjusted earnings before interest taxes, depreciation and amortization or Ebitda of $45 million and $50 million.

Lifeway Foods stock is down 19% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239899916_jpg_cde8ab32f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240244443_jpg_6b67e8f303.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)