Advertisement|Remove ads.

Lightspeed Commerce Stock Slides As Impairment Charge Hits Earnings: But Retail’s Optimistic

Lightspeed Commerce Inc. (LSPD) shares declined 7% on Thursday after its fourth-quarter (Q4) earnings fell short of Wall Street estimates.

Lightspeed’s total Q4 revenue rose 10% year-over-year (YoY) to $253.4 million, surpassing the analyst consensus estimate of $251.30 million, per Finchat data.

Adjusted earnings per share (EPS) of $0.10 marginally missed the consensus estimate of $0.11.

Transaction-based revenue reached $157.8 million, up 14%, while subscription revenue grew 8% to $87.9 million.

Despite these gains, the company reported a net loss of $575.9 million, primarily due to a $556.4 million goodwill impairment charge.

Gross profit climbed 12% to $111.8 million, and the gross margin expanded 70 basis points to 44%.

The operating loss for the quarter widened to $580 million. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) stood at $12.9 million, up from $4.4 million in the fourth quarter of 2024.

During the quarter, Lightspeed introduced several new product features, including seasonal trends and sales visualizations in Retail Insights, a generative AI web builder, enhancements to Lightspeed NuORDER with PO Sync, and upgraded omni gift cards.

Lightspeed plans to grow its outbound sales team to over 150 representatives by the end of fiscal 2026 and increase investment in product and technology development by over 35%.

The company projects revenue of approximately $285 million to $290 million for the first quarter of FY26, with full-year revenue growth expected between 10% and 12%.

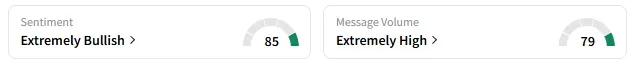

On Stocktwits, retail sentiment around Lightspeed changed to ‘extremely bullish’ from ‘bullish’ the previous day.

A user was surprised by the adjusted EPS miss.

Lightspeed stock has lost over 34% in 2025 and 30% in the past 12 months.

Also See: Snowflake Stock Rises As Wall Street Lifts Price Target Post Q1 Print: Retail Stays Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)