Advertisement|Remove ads.

Snowflake Stock Rises As Wall Street Lifts Price Target Post Q1 Print: Retail Stays Optimistic

Snowflake, Inc. (SNOW) shares jumped nearly 10% in Thursday’s premarket after reporting better-than-expected first-quarter earnings.

Bozeman, Montana-based Snowflake’s revenue improved 26% year over year (YoY) to $1.04 billion, beating the analysts consensus estimate of $1.01 billion, as per Finchat data.

The adjusted earnings per share (EPS) of $0.24 also beat the consensus estimate of $0.21.

Following the earnings, analysts from several brokerages increased the stock’s price target to reflect Wall Street’s optimism.

Morgan Stanley has raised its price target on Snowflake to $200, up from $185, while maintaining its ‘Equal Weight’ rating, as per TheFly.

The firm noted that continued momentum from sales strategy adjustments and growing adoption of newer offerings contribute to steady product revenue growth.

Citing enhanced long-term industry trends, a stronger focus on data infrastructure, and improving profit margins, the analyst suggested that market dips may offer a favorable opportunity to adopt a more bullish stance.

Wells Fargo has lifted its price target to $225 from the previous $200 and reiterated its ‘Overweight’ rating.

According to the firm, Snowflake posted a strong Q1 performance that exceeded expectations, showing no visible effects from broader economic conditions.

Wells noted that a pick-up in growth outlook in the second half of the year appears increasingly realistic, particularly with momentum building around a new wave of products.

Piper Sandler increased its price target to $215 from $175 while maintaining an ‘Overweight’ rating on the stock.

The firm continues to view Snowflake as one of its top high-conviction growth picks for 2025, citing its alignment with a Rule of 50 strategy, combining 25% revenue growth with over 25% free cash flow margins at a scale of more than $4 billion in annual recurring revenue (ARR).

Piper noted that Snowflake's strong performance in the first quarter, including a $39 million revenue beat and 26% year-over-year product growth, was a positive sign despite ongoing macroeconomic uncertainty.

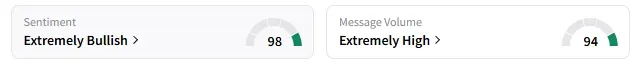

On Stocktwits, retail sentiment around Snowflake remained in ‘extremely bullish’ territory.

A bullish watcher expects the stock to hit $300.

Snowflake stock has gained 16% year-to-date and over 9% in the past 12 months.

Also See: Aurora Mobile’s Global Contracts Surge Past $13M: Retail’s Exuberant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)