Advertisement|Remove ads.

Air-Taxi Firm Lilium’s Stock Nosedives On Insolvency Warning: Retail Mood Darkens

Shares of Lilium NV ($LILM) crashed over 54% on Thursday after the German electric vertical take-off and landing (eVTOL) company warned that its main subsidiaries may soon need to file for insolvency.

Despite ongoing fundraising efforts, the company said it has not been able to raise sufficient capital to continue operating its two main subsidiaries, Lilium GmbH and Lilium eAircraft GmbH, which are now “over-indebted”.

Last week, Lilium received notice that the German Federal Parliament’s budget committee would not approve a €50 million guarantee for a proposed €100 million convertible loan from KfW.

Additionally, Lilium has yet to secure an agreement with the Free State of Bavaria for another €50 million guarantee.

Following the news, short-seller Iceberg Research released a report branding Lilium a fraud, accusing it of misrepresenting its progress toward commercialization.

The report claims that Lilium should have run out of cash by now if not for a $100 million at-the-money offering that could only keep operations running until January 2025.

Iceberg Research criticized Lilium’s plea for government support, calling it misleading and urging European governments not to fund the company.

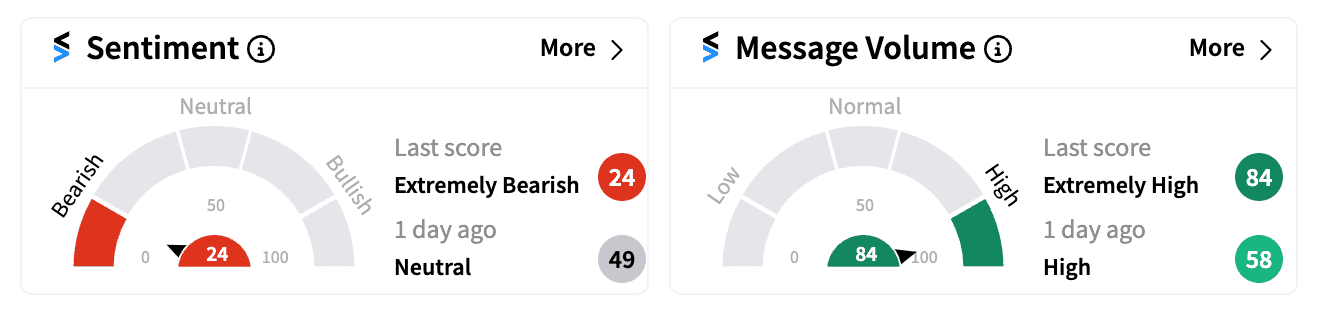

On Stocktwits, retail sentiment for LILM plunged from ‘neutral’ to ‘extremely bearish’ (24/100) by Thursday morning, with considerable frustration over the company’s recent announcements.

A day earlier, Lilium had touted a partnership with GE Aerospace to enhance safety standards for eVTOL operators, which now seems overshadowed by the insolvency warning.

Cantor Fitzgerald and Canaccord had both downgraded Lilium earlier this month, with Cantor withdrawing its previous $2 price target. The analysts were disappointed by the denial of the German loan, which was seen as essential for Lilium’s short-term survival and potential to attract additional investors.

Lilium recently made a big push into the U.S. market by debuting a fully electric eVTOL aircraft, with proposed routes connecting cities like Houston and Galveston.

However, with the company’s financial outlook worsening, hopes of seeing these routes materialize are dimming.

LILM shares have now lost nearly 80% of their value this year.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitdeer_0adcf9a760.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254687746_jpg_9f8228b6ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cfpb_resized_png_ad08d8de38.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_52154609_jpg_bc5ad676b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_7ed87bb07c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)