Advertisement|Remove ads.

Liquidity Services Stock Surges On Q4 Earnings Beat: Retail Sentiment Brightens

Shares of Liquidity Services ($LQDT) rose 30% on Thursday after the global commerce company posted better-than-expected fourth-quarter earnings, lifting retail sentiment.

Earnings per share stood at $0.32, above the expected $0.28 quoted by Wall Street analysts. Reported revenues were $106.93 million, beating the expected $50.88 million, driven by strength in gross merchandise volumes.

Its revenues stood at $106.9 million, rising 34% from the same period in 2023. Revenues in its RSCG segment rose 49%, “reflecting that increase in its overall GMV was driven by broader expansions in purchase programs relative to consignment programs,” the company said. Its revenues in its GovDeals segment increased by 26% in comparison.

“Our strong fourth-quarter results capped a successful year of market share expansion and consistent growth in Fiscal Year 2024 backed by investments in innovation, service, and execution for our customers,” Bill Angrick, Chairman & CEO, said in a statement, adding the company is seeing enhanced network effects in its two-sided marketplace platform.

“We achieved double-digit consolidated GMV growth in each quarter throughout the year and each of our segments achieved double-digit annual GMV growth, culminating in record annual GMV of $1.4 billion,” he said.

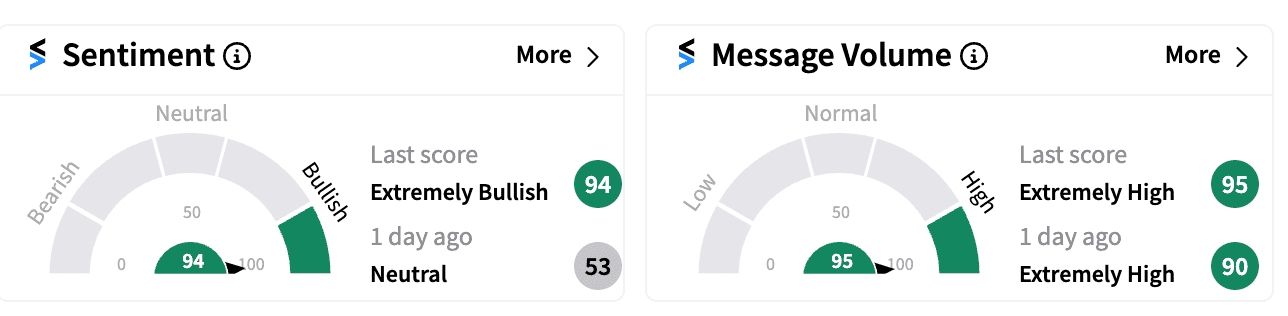

Retail sentiment on the stock turned ‘extremely bullish’ (94/100) from ‘neutral’ (53/100) a day ago. Message volumes continued to be in the ‘extremely high’ zone.

For the next quarter, the company expects GMV to be between $350 million and $385 million. Non-GAAP adjusted diluted EPS is pegged at between $0.18 and $0.26.

Liquidity Services’ e-commerce solutions help manage, value, and sell inventory and equipment for business and government clients.

Liquidity Services stock is up 96% year-to-date.

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)