Advertisement|Remove ads.

Lithium Americas' Stock Surge Captures Wall Street Attention: Here’s Why

Lithium Americas Corp. (LAC) stock surged over 72% in Wednesday’s premarket trading following a report that the U.S. government is eyeing a potential equity stake in the company, tied to a $2.26 billion loan revision for its Thacker Pass lithium project.

U.S. officials decided to revisit the loan terms out of concern that the company might struggle to repay it, given the current low prices of lithium. However, JPMorgan issued a cautious response to the stock’s rally, calling the market’s reaction excessive given the uncertainty surrounding the terms of the deal, according to TheFly.

The firm noted that while the idea of a 10% stake from the government has attracted attention, it's unclear what that would actually mean in terms of valuation, especially without more details on any revised lithium offtake agreements.

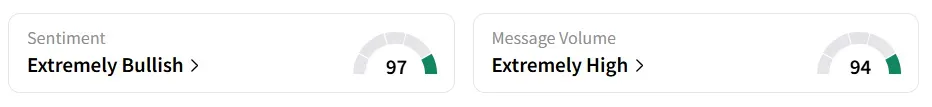

On Stocktwits, retail sentiment around Lithium Americas stock remained in ‘extremely bullish’ territory. Message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

General Motors Co. (GM), which had already secured exclusive rights to the output from Phase 1 of the Thacker Pass operation, remains central to the discussions. According to JPMorgan, GM’s existing agreement already positioned it as the sole buyer of the mine’s initial production phase, which makes any new guarantees less important than headlines might suggest.

Jefferies trimmed its price target for Lithium Americas to $7 from $8, but maintained a ‘Buy’ rating.

In a brief response to the media report, Lithium Americas confirmed that conversations are still ongoing and include certain conditions precedent to draw on the DOE Loan, as well as the associated loan specifics and incremental requests from the DOE for potential further conditions.

Lithium Americas' stock has gained over 3% in 2025 and over 24% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)