Advertisement|Remove ads.

Liveramp Stock Soars 23% On Strong Q4 Print, Price Target Hikes On Wall Street: But Retail Turns Bearish

Liveramp Holdings Inc. (RAMP) shares jumped 23% on Thursday morning after reporting better-than-expected fourth-quarter (Q4) earnings.

The software-as-a-service (SaaS) company’s Q4 revenue climbed 10% year-on-year (YoY) to $189 million, beating the analyst consensus estimate of $185.41 million, as per Finchat data.

The adjusted earnings per share (EPS) of $0.30 also surpassed the consensus estimate of $0.28.

Following the earnings, Wall Street analysts raised their price targets to reflect optimism.

Wells Fargo increased its price target to $31 from $26 while maintaining an ‘Equal Weight’ rating on the stock, as per TheFly.

Wells also highlighted the company’s solid performance in Q4 2025 and noted that its FY26 revenue guidance was 3% above expectations at the high end.

Additionally, the brokerage said remaining performance obligations (RPO) showed stronger momentum, rising 25% YoY in Q4 compared to 6% in the third quarter (Q3). However, this growth was primarily fueled by contract renewals rather than new customer acquisitions.

Benchmark has raised its price target to $48 from $45 and continues to rate the stock as a ‘Buy’.

The firm praised the company’s latest quarterly performance, calling it “an exceptional quarter” despite ongoing challenges in commerce media and broader economic uncertainty.

Although LiveRamp still faces macroeconomic headwinds, the brokerage pointed out that management’s FY26 revenue outlook includes what they described as a “healthy dose of conservatism,” even at the lower end of the forecast.

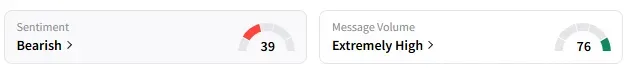

On Stocktwits, retail sentiment around Liveramp changed to ‘bearish’ from ‘bullish’ the previous day.

Liveramp stock has gained over 12% in 2025 and 5% in the last 12 months.

Also See: Aurora Mobile’s Global Contracts Surge Past $13M: Retail’s Exuberant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)