Advertisement|Remove ads.

Eli Lilly Stock Slides Pre-Market On Weight-Loss Drug Sales Miss, But Retail Eyes Buying Opportunity

Eli Lilly & Co. ($LLY) shares fell over 9% in pre-market trading Wednesday after the company’s third-quarter profit and revenue missed analyst expectations by a wide margin.

Weaker-than-expected sales of its popular weight-loss drugs, Mounjaro and Zepbound, dented market confidence even as retail sentiment remained more optimistic.

The company reported net income of $970.3 million, or $1.07 per share, compared to a loss of $57.4 million, or $0.06 per share, a year earlier.

Adjusted earnings per share stood at $1.18, below the FactSet consensus of $1.45.

Total revenue rose 20.4% to $11.44 billion, though it fell short of the expected $12.09 billion.

Mounjaro sales surged by 120.9% to $3.11 billion but missed the estimated $3.77 billion, while Zepbound sales came in at $1.26 billion, below the anticipated $1.73 billion.

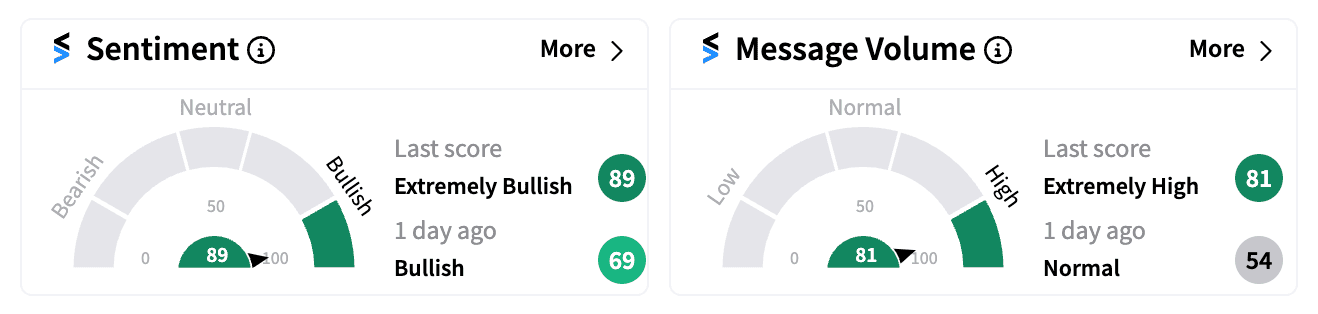

Despite this earnings miss, retail sentiment on Stocktwits turned ‘extremely bullish,’ (89/100) with a marked increase in message volume.

Several retail investors saw the stock’s weakness as a buying opportunity, eyeing the broader potential of Lilly’s weight-loss and diabetes treatments.

Looking ahead, Lilly cut its full-year guidance for adjusted EPS to a range of $13.02–$13.52, down from the previous range of $16.10–$16.60, and trimmed its revenue outlook to between $45.4 billion and $46 billion, versus the earlier $45.4 billion to $46.6 billion.

Lilly’s blockbuster GLP-1 weight-loss and diabetes drugs, Mounjaro and Zepbound, have propelled it to one of the world’s most valuable companies, with a market cap of over $850 billion.

While Lilly’s broader portfolio spans diabetes, cancer, and neuroscience treatments, investors remain largely focused on Mounjaro and Zepbound.

Both drugs, which contain the GLP-1 receptor agonist tirzepatide, have seen skyrocketing demand in the U.S., creating supply challenges.

Although the FDA declared the drugs are no longer in shortage as of October 2, Lilly warned that continued demand might lead to “periodic supply tightness.”

Year to date, Lilly stock has risen 55%, outpacing the S&P 500’s 22.3% gain.

For updates and corrections, email newsroom@stocktwits.com

Read next: Corning Stock Boosts Retail Bullishness As Wall Street Analysts Raise Price Targets Post Q3 Earnings

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)