Advertisement|Remove ads.

Lockheed Martin Stock Hits November 2024 Highs On Production Agreement With Department Of War

- The plan, under a new seven-year framework, will boost annual PAC-3 MSE interceptor output from about 600 units to roughly 2,000.

- The production agreement comes under the Department of War’s Acquisition Transformation Strategy.

- With the agreement set to triple output, thousands of U.S. jobs are expected to be added across Lockheed Martin’s supplier network.

Lockheed Martin (LMT) stock reached November 2024 highs on Tuesday after the defense and aerospace manufacturer signed a major long-term agreement with the U.S. Department of War.

The deal is aimed at increasing production of the PAC-3 Missile Segment Enhancement (MSE) interceptor, a key defensive weapon for the Patriot air-and-missile defense system.

Production Expansion Plan

The move comes as demand for advanced air defense systems grows among U.S. military forces and allied nations. The plan, under a new seven-year framework, will boost annual PAC-3 MSE interceptor output from about 600 units to roughly 2,000, with work beginning immediately and ramping up over time.

The defense giant has already grown its manufacturing by more than 60% in the last two years and delivered 620 interceptors in 2025, surpassing the prior year’s total by over 20%.

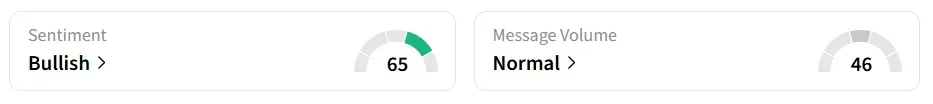

Lockheed Martin stock traded over 4% higher on Tuesday mid-morning. On Stocktwits, retail sentiment around the stock remained in’bullish’ territory, while message volume shifted to ‘normal’ from ‘low’ levels in 24 hours.

Acquisition Transformation

The production agreement comes under the Department of War’s Acquisition Transformation Strategy. The strategy assures long-term demand certainty, encouraging investment from suppliers like Lockheed Martin. This new acquisition model aims to modernize weapons procurement, shorten lead times, and strengthen efficiencies across the defense industrial base.

With this agreement set to triple output, thousands of U.S. jobs are expected to be added across Lockheed Martin’s supplier network.

“We will create unprecedented capacity for PAC-3 MSE production, delivering at the speed our nation and allies demand while providing value for taxpayers and our shareholders."

-Jim Taiclet, Chairman, President and CEO, Lockheed Martin

In December, the company received a contract worth more than $1 billion from the Space Development Agency to build 18 satellites for its Tranche 3 Tracking Layer program.

LMT stock has gained over 13% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)