Advertisement|Remove ads.

Loews Corp Stock Falls After Q4 Hit By Subsidiary CNA Financial’s $265M Pension Settlement Charges: Retail’s Neutral

Shares of Loews Corp (L) traded marginally in the red on Monday after the company’s fourth-quarter earnings took a hit from a $265 million pension settlement charge for CNA Financial Corporation.

Revenue rose nearly 7% year-over-year (YoY) to $4.55 billion during the quarter, while net income fell to $187 million compared to $446 million a year earlier.

For CNA, net income attributable to Loews Corporation, excluding the pension charge, came in at $284 million compared to $336 million.

Loews said that Boardwalk Pipelines' results improved year-over-year mainly due to increased revenues in the fourth quarter from re-contracting at higher rates and recently completed growth projects. Its net income rose to $145 million compared to $92 million.

Meanwhile, Loews Hotels saw net income fall to $27 million compared to $32 million. The decrease was primarily due to higher depreciation and interest expense related to the opening of the Arlington Hotel and Convention Center in the first quarter of 2024.

During the quarter, Loews Corporation repurchased 4.2 million and 7.7 million shares of its common stock for a total cost of $349 million and $611 million, respectively.

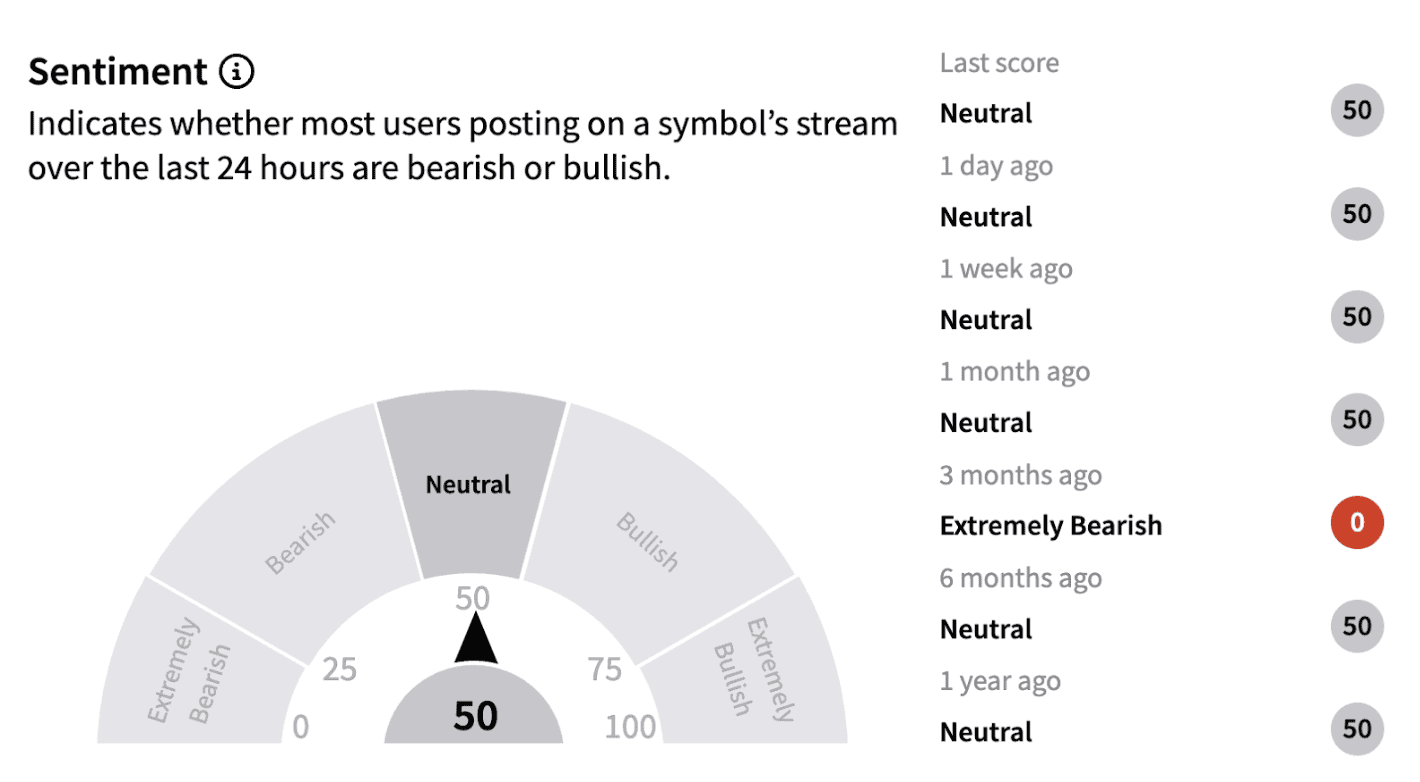

On Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory (50/100) following the earnings report.

As of Dec. 31, 2024, the parent company had $3.3 billion of cash and investments and $1.8 billion of debt.

Loews shares have gained over 2.5% in 2025 and have risen over 18% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)