Advertisement|Remove ads.

Loews Corp Stock In Focus After Strong Q3 Earnings Report: Retail Enthusiasm Soars

Shares of Loews Corp ($L) opened in the red on Monday morning after the firm reported its third-quarter results.

Revenue grew nearly 14% year-over-year (YoY) to $4.47 billion during the quarter while earnings per share (EPS) came in at $1.82 compared to $1.12 in the same period last year. Net income rose 58% YoY to $401 million.

From a segmental point of view, CNA Financial’s net income attributable to Loews Corporation improved 10% to $259 million from $235 million. The insurance company’s net written premiums grew by 8% led by strong retention and new business.

Its net investment income growth was primarily led by higher returns from limited partnership and common stock investments. Income from fixed income securities also rose due to favorable reinvestment rates and a larger invested asset base.

Meanwhile, Boardwalk’s net income rose 57% to $77 million and earnings before interest, tax, depreciation, and amortization (EBITDA) rose 23% to $249 million. Loews said that net income and EBITDA improved due to increased transportation revenues from higher re-contracting rates and recently completed growth projects, increased storage and parking and lending revenues, and contribution from the Bayou Ethane acquisition.

Loews Hotels, however, recorded a net loss of $8 million, due to an impairment charge recorded by a joint venture property and higher depreciation and interest expense due to the opening of the Loews Arlington Hotel and Convention Center in the first quarter of 2024.

Loews CEO James S. Tisch said Boardwalk continues to benefit from favorable industry tailwinds that have led to higher re-contracting rates and robust pipeline flows while CNA performed well despite elevated industry catastrophe losses.

During the third quarter, Loews Corporation repurchased 0.8 million shares of its common stock for a total cost of $64 million while during the current quarter, it repurchased an additional 1.2 million shares for $92 million.

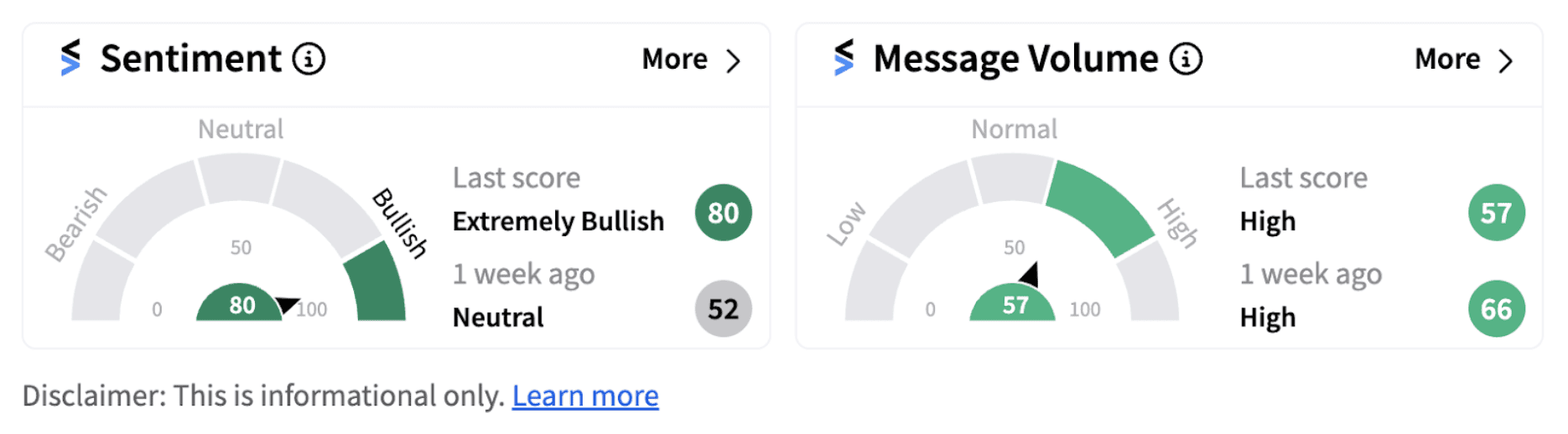

Following the announcement, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (80/100) from ‘neutral’ a week ago.

Also See: Constellation Energy In Focus After Q3 Beat: Despite Stock Slide, Retail Remains Confident

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2018/03/shutterstock_574323772.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/08/startup_funding1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/2025-08-05t045421z-1959791813-rc26kda2b3it-rtrmadp-3-indusind-bank-stocks-2025-08-68f6aea16b508e51a6b3547f6d7ae2a1.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/02/rice_exports.jpg)