Advertisement|Remove ads.

After Stellar Q1, L&T’s Technical Setup Signals Retest Of All-Time Highs, Say SEBI RAs

Larsen & Toubro (L&T) shares surged nearly 5% on Wednesday as it kicked off FY26 with record order inflows, strong profit growth, and visible bullish cues on the technical charts.

The engineering and construction major reported a strong beat across metrics for the June quarter (Q1 FY26) and its highest-ever Q1 order inflows. Order inflows saw 33% growth at ₹94,453 crore, with the total orderbook now standing at ₹6.12 lakh crore. International business contributed to 52% of orders and revenues.

L&T Q1 revenues rose 16% to ₹63,679 crore, and profits rose 30% to ₹3,617 crore. The management’s focus is now on scaling digital infra, semiconductors, and green hydrogen projects, and enhancing profitability while diversifying into tech-aligned verticals

Technical Watch

On the technical front, SEBI-registered analyst Rajneesh Sharma noted that despite a wedge breakdown earlier in 2025, the chart structure continues to support a bullish stance.

Since 2021, L&T has been moving in a rising channel, and the recent price action shows stability above key support near ₹3,257. Sharma believes that a breakout retest around ₹3,722 is in progress, and reclaiming this level would confirm its bullish trend.

Other momentum indicators support this outlook. The Relative Strength Index (RSI) broke the downtrend and now stands at 53.57, suggesting a positive momentum shift. The Chaikin Money Flow (CMF) at +0.17 signals an accumulation phase. The lack of spike in volumes indicates that the price move is driven by technical factors and not just an earnings reaction.

Sharma noted resistance levels at ₹3,722.25 (trendline retest), and ₹3,892.60 (all-time high). On the downside, support is seen at ₹3,257.25 (horizontal base), and ₹2,962.60 (bottom of rising channel). He added that the mid-term chart view is bullish, and a sustained move above ₹3,722 could trigger a retest of the all-time high.

With both earnings and technicals aligned, Larsen & Toubro offers a compelling case for continued strength, according to him.

Meanwhile, analyst Saurabh Sahu noted that the stock has corrected nearly 6% from recent highs (~₹3,700) and was now approaching a consolidation zone with early signs of demand re-emerging.

He advised traders to watch for support around ₹3,400–3,450. A rebound from here may suggest mean reversion or trend reversal. A pullback could present a technical accumulation opportunity for long-term investors.

According to Sahu, a robust order pipeline, strong cash flows, and scaling up of the digital and energy transition businesses are driving confidence in this stock. He recommended a Buy with a short-term target of ₹3,600, and suggested a stop loss below ₹3,400 closing (a key support level).

Volume stability with lower selling pressure and a favourable risk-reward are the factors behind his outlook. Sahu identified the next resistance zone for L&T at ₹3,700–₹3,800.

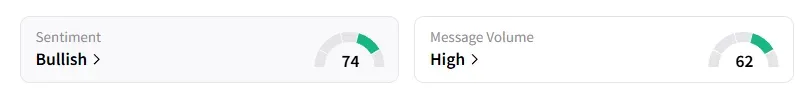

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago amid ‘heavy’ message volumes on the platform.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)